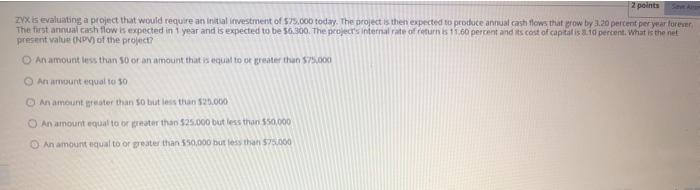

Question: 2 points ZYX is evaluating a project that would require an initial investment of $25.000 today. The project is the expected to produce annual cash

2 points ZYX is evaluating a project that would require an initial investment of $25.000 today. The project is the expected to produce annual cash flows that grow by 3.20 percent per year forever The first annual cash flow is expected in 1 year and expected to be 56.300. The projec's internal rate of return is 1160 percent and its cost of capitalis 10 percent. What is the net present value (NPV) of the project? An amountless than 50 or an amount that is equal to or greater than 575.000 An amount equal to 50 An amount ater than 50 but less than $25.000 An amount equal to orter than $25.000 but less than 550,000 An amount equal to or greater than 550,000 but less than $75.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts