Question: 2. (Practice Set 4, part 1, #7) Suppose a project requires purchasing equipment worth $10 M. At the end of year 3 the equipment will

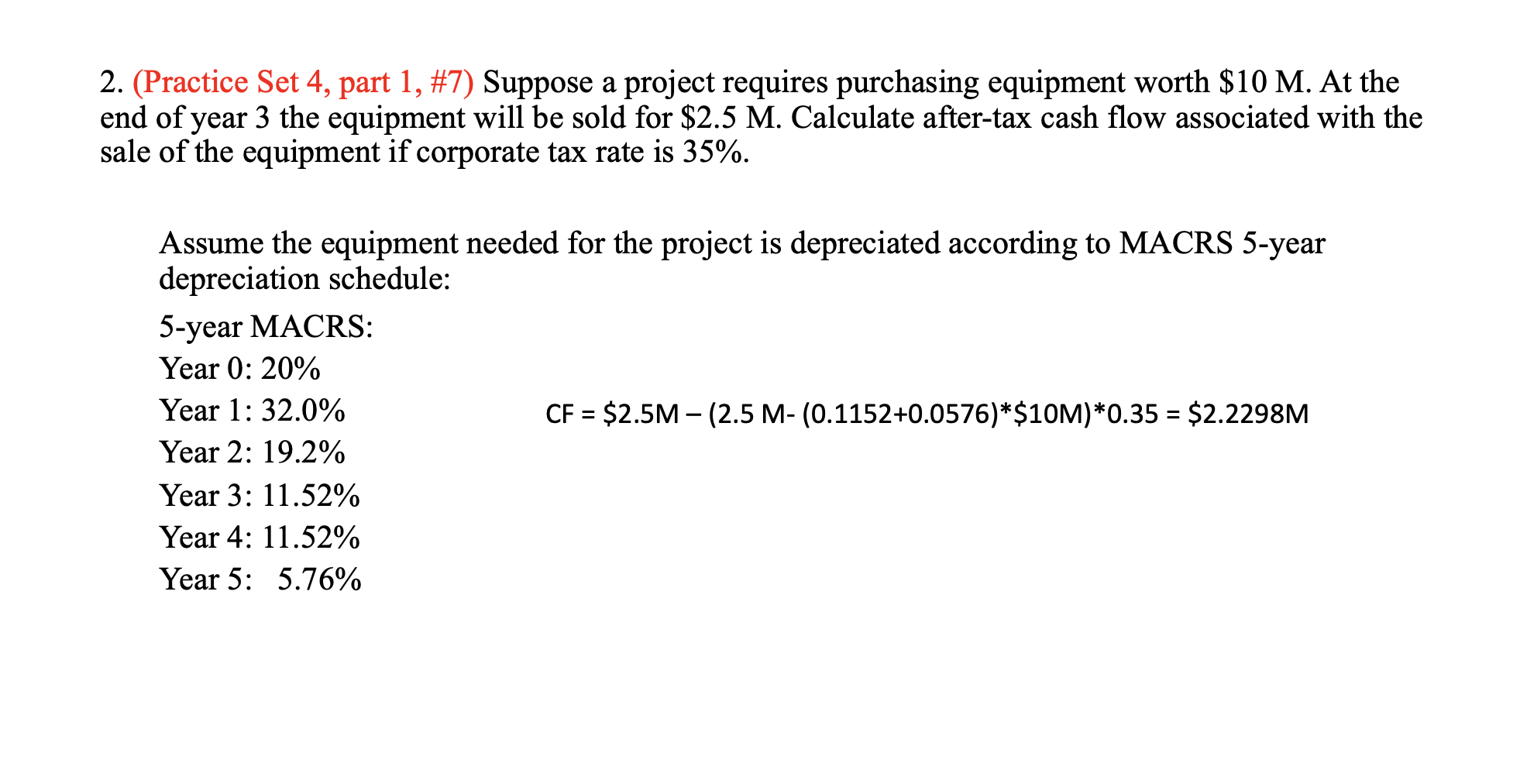

2. (Practice Set 4, part 1, #7) Suppose a project requires purchasing equipment worth $10 M. At the end of year 3 the equipment will be sold for $2.5 M. Calculate after-tax cash flow associated with the sale of the equipment if corporate tax rate is 35%. Assume the equipment needed for the project is depreciated according to MACRS 5-year depreciation schedule: 5-year MACRS: Year 0: 20% Year 1: 32.0% CF = $2.5M - (2.5 M-(0.1152+0.0576)*$10M)*0.35 = $2.2298M Year 2: 19.2% Year 3: 11.52% Year 4: 11.52% Year 5: 5.76% = =

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock