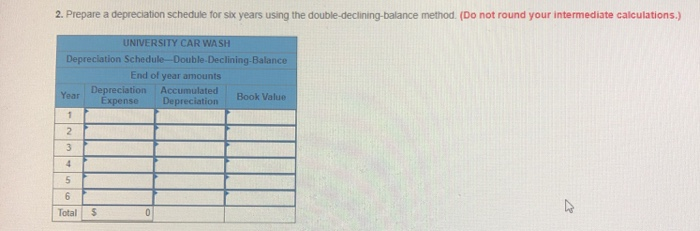

Question: 2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.) UNIVERSITY CAR WASH Depreclation Schedule-Double-Declining-Balance End of

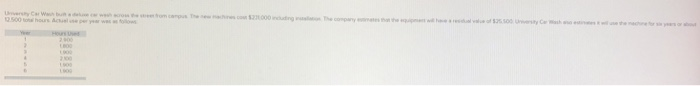

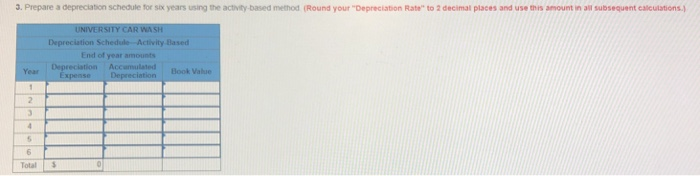

2. Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.) UNIVERSITY CAR WASH Depreclation Schedule-Double-Declining-Balance End of year amounts va Depreciation Accumulated nse Depreciation Book Value Total 3. Prepare a depreciation schedule tor six years using the activity-based method (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations. Depreciation Schedude -Activity Based End of year amounts Depreciation Acc 1 Book Vabue Year Total3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts