Question: 2. Prepare a Pro-forma income statement, and balance sheet and cash budget statement, for your company, on a monthly bases for the 2d quarter, and

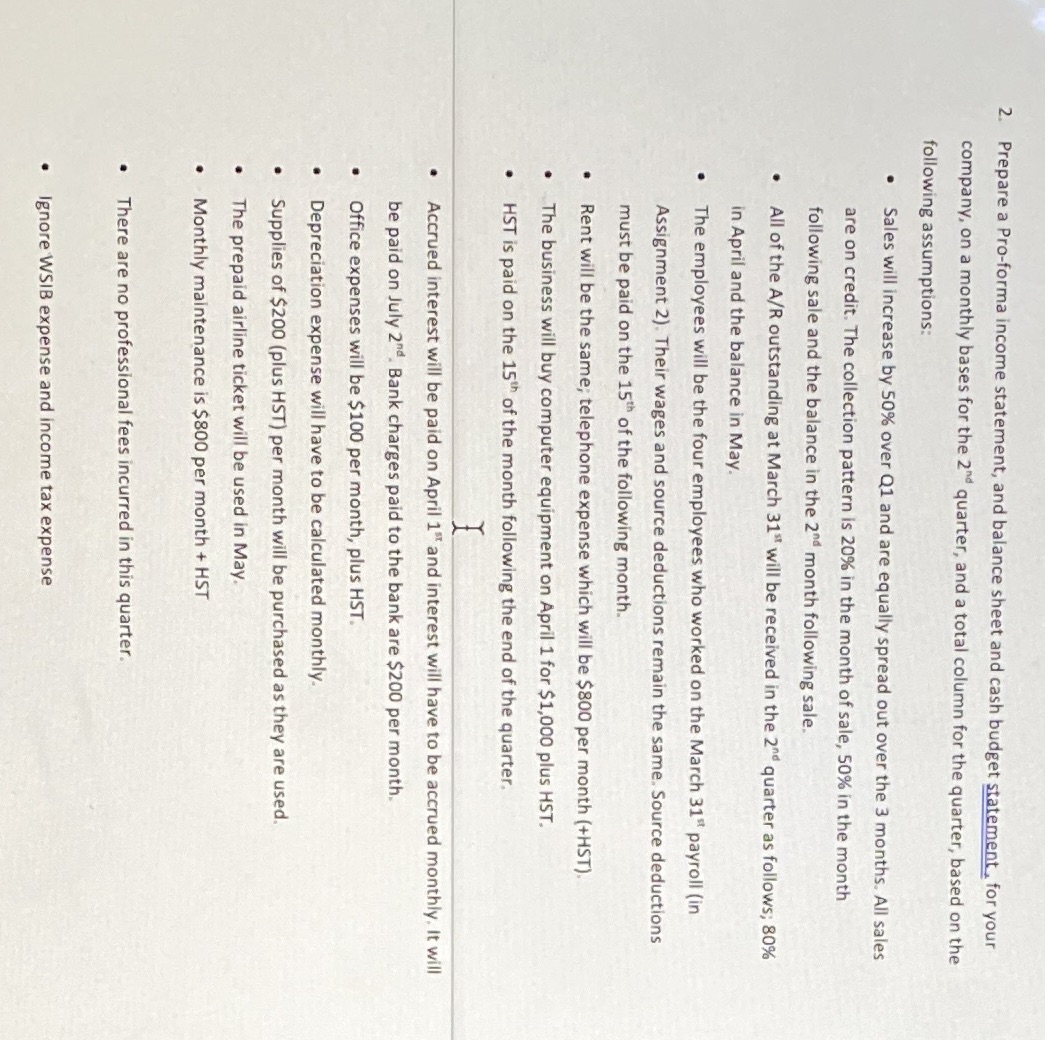

2. Prepare a Pro-forma income statement, and balance sheet and cash budget statement, for your company, on a monthly bases for the 2"d quarter, and a total column for the quarter, based on the following assumptions: Sales will increase by 50% over Q1 and are equally spread out over the 3 months. All sales are on credit. The collection pattern is 20% in the month of sale, 50% in the month following sale and the balance in the 2" month following sale. All of the A/R outstanding at March 31" will be received in the 20d quarter as follows; 80% in April and the balance in May. . The employees will be the four employees who worked on the March 31" payroll (in Assignment 2). Their wages and source deductions remain the same. Source deductions must be paid on the 15th of the following month. Rent will be the same; telephone expense which will be $800 per month (+HST). . The business will buy computer equipment on April 1 for $1,000 plus HST. . HST is paid on the 15"h of the month following the end of the quarter. . Accrued interest will be paid on April 1" and interest will have to be accrued monthly. It will be paid on July 2"d. Bank charges paid to the bank are $200 per month. Office expenses will be $100 per month, plus HST. . Depreciation expense will have to be calculated monthly. . Supplies of $200 (plus HST) per month will be purchased as they are used. The prepaid airline ticket will be used in May. . Monthly maintenance is $800 per month + HST . There are no professional fees incurred in this quarter. . Ignore WSIB expense and income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts