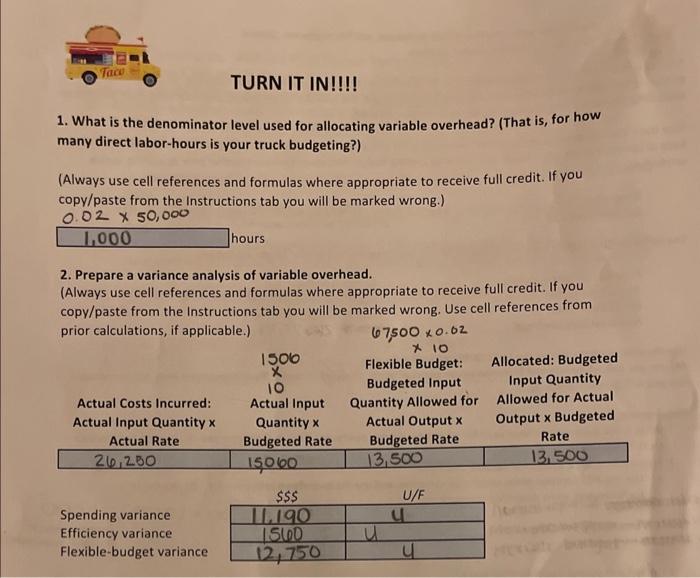

Question: 2. Prepare a Variance analysis of variable overhead (please provide solutions for the blue boxes) Flexible Budgets, Overhead Cost Variances, and Management Control Variable Overhead

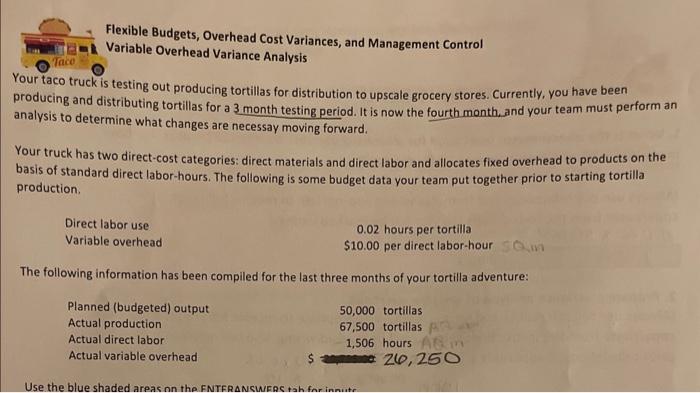

Flexible Budgets, Overhead Cost Variances, and Management Control Variable Overhead Variance Analysis Your taco truck is testing out producing tortillas for distribution to upscale grocery stores. Currently, you have been producing and distributing tortillas for a 3 month testing period. It is now the fourth month, and your team must perform an analysis to determine what changes are necessay moving forward. Your truck has two direct-cost categories: direct materials and direct labor and allocates fixed overhead to products on the basis of standard direct labor-hours. The following is some budget data your team put together prior to starting tortilla production. The following information has been compiled for the last three months of your tortilla adventure: Use the blue shaded areas nn the FNTFR NSWFRS tah fnr innute 1. What is the denominator level used for allocating variable overhead? (That is, for how many direct labor-hours is your truck budgeting?) (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.) 0.0250,000 hours 2. Prepare a variance analysis of variable overhead. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Use cell references from

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts