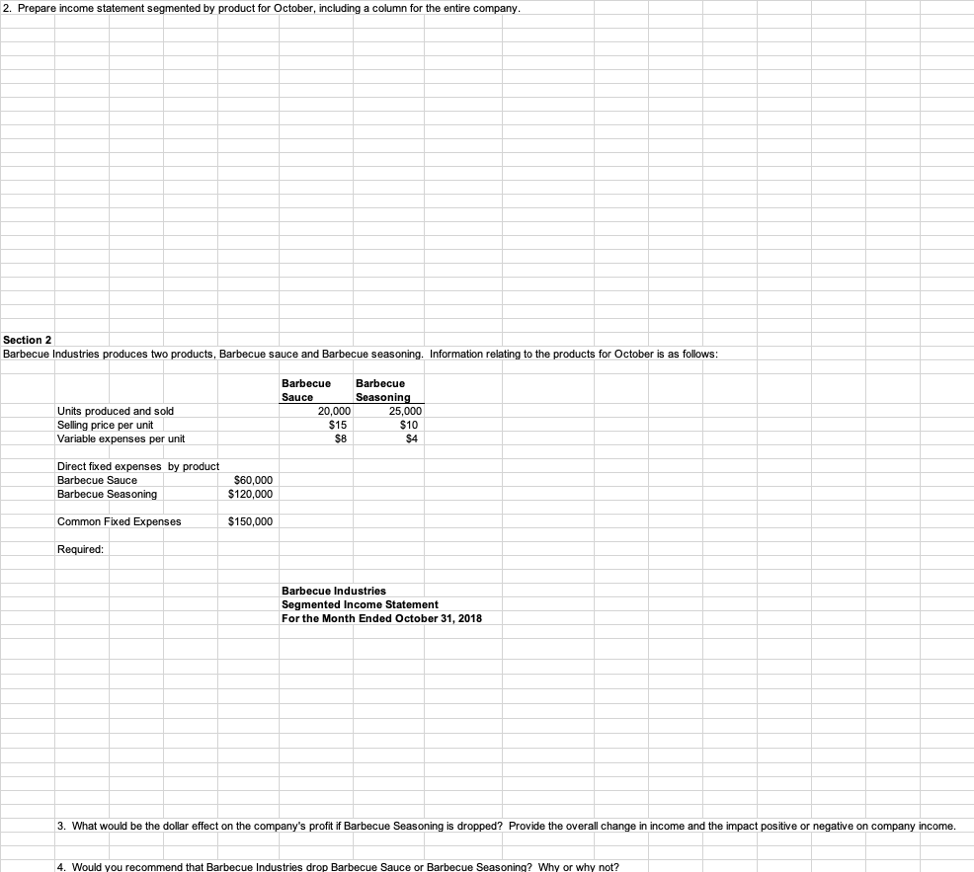

Question: 2. Prepare income statement segmented by product for October, including a column for the entire company Section 2 Barbecue Industries produces two products, Barbecue sauce

2. Prepare income statement segmented by product for October, including a column for the entire company Section 2 Barbecue Industries produces two products, Barbecue sauce and Barbecue seasoning, Information relating to the products for October is as follows Barbecue Sauce Barbecue Seasonin Units produced and sold Seling price per unit Variable expenses per unit 20,000 $15 S8 25,000 $10 S4 Direct fixed expenses by product Barbecue Sauce Barbecue Seasoning S60,000 $120,000 Common Fixed Expenses 150,000 Required: Barbecue Industries Segmented Income Statement For the Month Ended October 31, 2018 3. What would be the dollar effect on the company's profit if Barbecue Seasoning is dropped? Provide the overall change in income and the impact positive or negative on company income. 4. Would you recommend that Barbecue Industries drop Barbecue Sauce or Barbecue Seasoning? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts