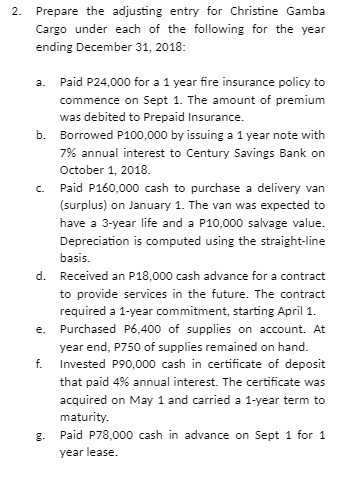

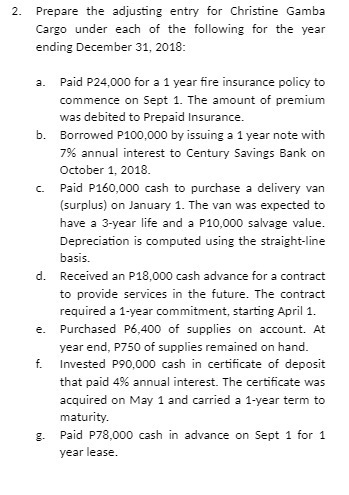

Question: 2. Prepare the adjusting entry for Christine Gamba Cargo under each of the following for the year ending December 31, 2018: a. Paid P24,000 for

2. Prepare the adjusting entry for Christine Gamba Cargo under each of the following for the year ending December 31, 2018: a. Paid P24,000 for a 1 year fire insurance policy to Commence on Sept 1. The amount of premium was debited to Prepaid Insurance. b. Borrowed P100,000 by issuing a 1 year note with 7% annual interest to Century Savings Bank on October 1, 2018. c. Paid P160,000 cash to purchase a delivery van (surplus) on January 1. The van was expected to have a 3-year life and a P10,000 salvage value. Depreciation is computed using the straight-line basis. d. Received an P18,000 cash advance for a contract to provide services in the future. The contract required a 1-year commitment, starting April 1. e. Purchased P6,400 of supplies on account. At year end, P750 of supplies remained on hand. Invested P90,000 cash in certificate of deposit that paid 4% annual interest. The certificate was acquired on May 1 and carried a 1-year term to maturity. g. Paid P78,000 cash in advance on Sept 1 for 1 year lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts