Question: 2. Prepare the adjusting entry to record bad debts expense at December 31. (Round percentage answers to nearest whole percent. Do not round intermediate calculations.)

2. Prepare the adjusting entry to record bad debts expense at December 31. (Round percentage answers to nearest whole percent. Do not round intermediate calculations.)

3. On June 30 of the next year, Jarden concludes that a customers $4,150 receivable is uncollectible and the account is written off. Does this write off directly affect Jarden's net income?

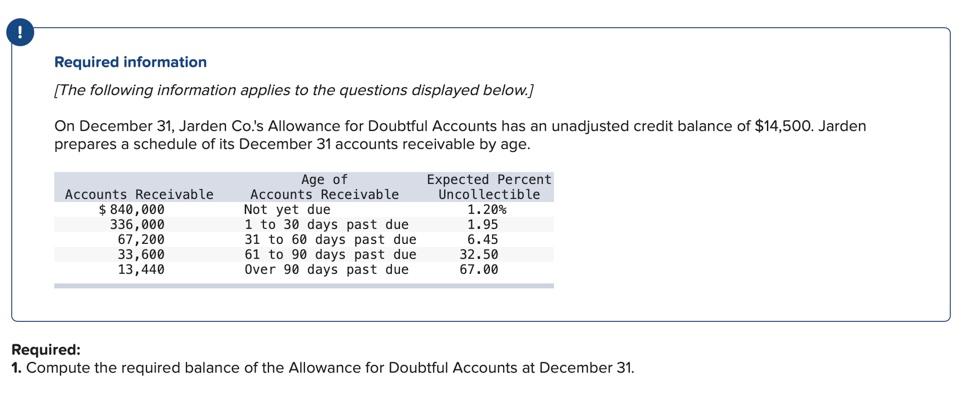

! Required information [The following information applies to the questions displayed below.) On December 31, Jarden Co.'s Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 840,000 336,000 67,200 33,600 13,440 Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Expected Percent Uncollectible 1.20% 1.95 6.45 32.50 67.00 Required: 1. Compute the required balance of the Allowance for Doubtful Accounts at December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts