Question: 2. (Pricing a S&P 500 Put by a Binomial model) The price of S&P 500 index on January 12, 2022 was $4,725 and the price

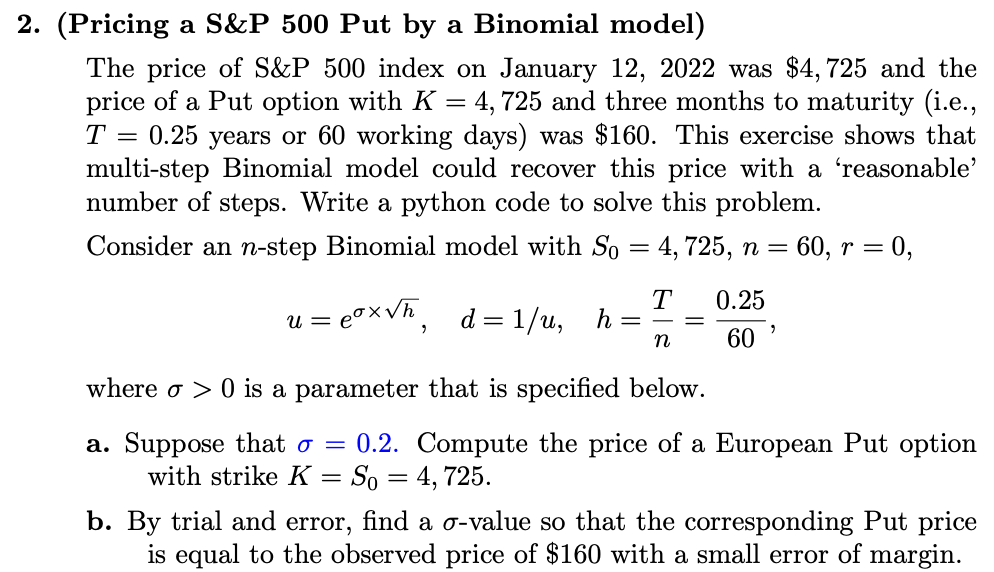

2. (Pricing a S&P 500 Put by a Binomial model) The price of S&P 500 index on January 12, 2022 was $4,725 and the price of a Put option with K = 4, 725 and three months to maturity (i.e., T 0.25 years or 60 working days) was $160. This exercise shows that multi-step Binomial model could recover this price with a 'reasonable' number of steps. Write a python code to solve this problem. Consider an n-step Binomial model with So = 4,725, n = 60, r = 0, = == = = u = eoxVh, d=1/u, h = T = n 0.25 60 where o > 0 is a parameter that is specified below. a. Suppose that o = 0.2. Compute the price of a European Put option with strike K = So = 4, 725. b. By trial and error, find a o-value so that the corresponding Put price is equal to the observed price of $160 with a small error of margin. 2. (Pricing a S&P 500 Put by a Binomial model) The price of S&P 500 index on January 12, 2022 was $4,725 and the price of a Put option with K = 4, 725 and three months to maturity (i.e., T 0.25 years or 60 working days) was $160. This exercise shows that multi-step Binomial model could recover this price with a 'reasonable' number of steps. Write a python code to solve this problem. Consider an n-step Binomial model with So = 4,725, n = 60, r = 0, = == = = u = eoxVh, d=1/u, h = T = n 0.25 60 where o > 0 is a parameter that is specified below. a. Suppose that o = 0.2. Compute the price of a European Put option with strike K = So = 4, 725. b. By trial and error, find a o-value so that the corresponding Put price is equal to the observed price of $160 with a small error of margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts