Question: 2. Pricing securities using the replicating portfolio approach from Chapter 1/Lecture 1. Assume that the economy will be either strong or weak in one

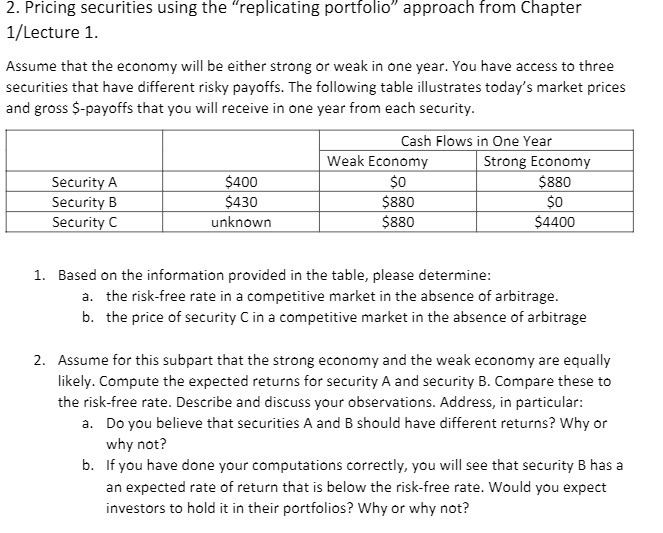

2. Pricing securities using the "replicating portfolio" approach from Chapter 1/Lecture 1. Assume that the economy will be either strong or weak in one year. You have access to three securities that have different risky payoffs. The following table illustrates today's market prices and gross $-payoffs that you will receive in one year from each security. Security A Security B Security C $400 $430 unknown Cash Flows in One Year Strong Economy $880 $0 $4400 Weak Economy $0 $880 $880 1. Based on the information provided in the table, please determine: a. the risk-free rate in a competitive market in the absence of arbitrage. b. the price of security C in a competitive market in the absence of arbitrage 2. Assume for this subpart that the strong economy and the weak economy are equally likely. Compute the expected returns for security A and security B. Compare these to the risk-free rate. Describe and discuss your observations. Address, in particular: a. Do you believe that securities A and B should have different returns? Why or why not? b. If you have done your computations correctly, you will see that security B has a an expected rate of return that is below the risk-free rate. Would you expect investors to hold it in their portfolios? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 a To determine the riskfree rate in a competitive market in the absence of arbitrage we can use the concept of noarbitrage pricing In this scenario ... View full answer

Get step-by-step solutions from verified subject matter experts