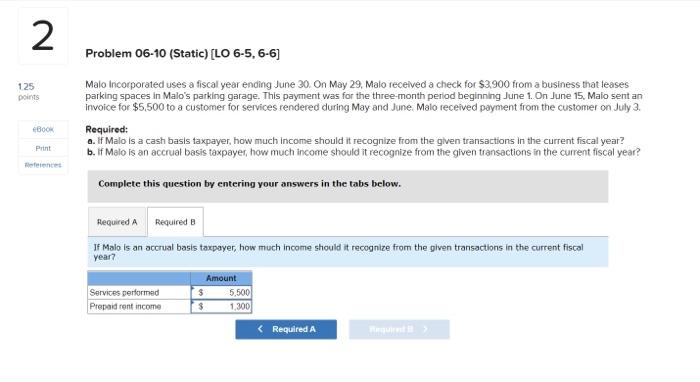

Question: 2 Problem 06-10 (Static) [LO 6-5, 6-6] 125 Doints Malo incorporated uses a fiscal year ending June 30. On May 29, Malo received a check

![2 Problem 06-10 (Static) [LO 6-5, 6-6] 125 Doints Malo incorporated](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb3220e37b7_40066fb32207f7fe.jpg)

2 Problem 06-10 (Static) [LO 6-5, 6-6] 125 Doints Malo incorporated uses a fiscal year ending June 30. On May 29, Malo received a check for $3,900 from a business that leases parking spaces in Malo's parking garage. This payment was for the three-month period beginning June 1. On June 15. Malo sent an invoice for $5,500 to a customer for services rendered during May and June. Malo received payment from the customer on July 3. Required: 6. I Malo is a cash basis taxpayer, how much income should it recognize from the given transactions in the current fiscal year? b. If Malo is an accrual basis taxpayer, how much income should it recognize from the given transactions in the current fiscal year? Book Print References Complete this question by entering your answers in the tabs below. Required A Required B If Malo is a cash basis taxpayer, how much Income should it recognize from the given transactions in the current fiscal year? Amount Services performed Prepaid font income 1 300 3.900 $ Required > 2 125 points Problem 06-10 (Static) [LO 6-5, 6-6] Malo Incorporated uses a fiscal year ending June 30. On May 29, Malo received a check for $3,900 from a business that leases parking spaces in Malo's parking garage. This payment was for the three-month period beginning June 1. On June 15. Malo sent an invoice for $5,500 to a customer for services rendered during May and June. Malo received payment from the customer on July 3. Required: 2. If Malo is a cash basis taxpayer, how much income should it recognize from the given transactions in the current fiscal year? b. If Malo is an accrual basis taxpayer how much income should it recognize from the given transactions in the current fiscal year? BOOK Print Complete this question by entering your answers in the tabs below. Required A Required B If Malo is an accrual basis taxpayer, how much income should it recognize from the given transactions in the current fiscal year? Amount Services performed $ 5,500 Prepaid rent income $ 1,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts