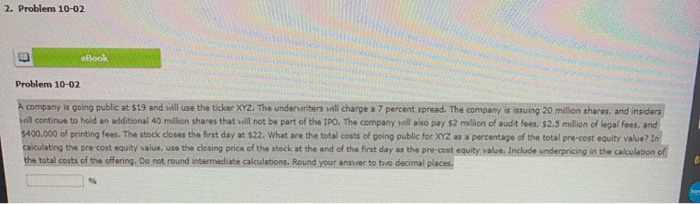

Question: 2. Problem 10-02 ebook Problem 10-02 A company is going public at $19 and will use the ticker XYZ. The underwriters will charge 37 percent

2. Problem 10-02 ebook Problem 10-02 A company is going public at $19 and will use the ticker XYZ. The underwriters will charge 37 percent spread. The company is issuing 20 million shares, and insiders Vill continue to hold an additional 40 million shares that will not be part of the IPO. The company will also pay $2 million of audit fees $2.5 million of legal fees, and 5400,000 of printing fees. The stock cloves the first day at $22. What are the total costs of going public for XYZ as a percentage of the total pre-cost equity value in calculating the pre-cost equity value to the closing price of the stock at the end of the first day as the pre-cost equity value. Include underpricing in the calculation of the total costs of the offering. Do not found intermediate calculations. Round your answer to be decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts