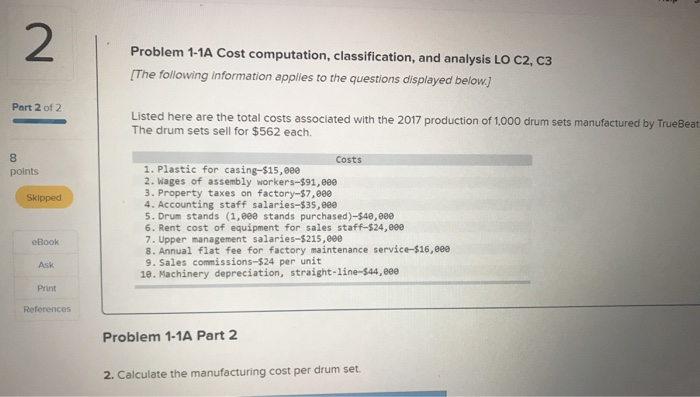

Question: 2 Problem 1-1A Cost computation, classification, and analysis LO C2, C3 The following information applies to the questions displayed below.] Part 2 of 2 Listed

![The following information applies to the questions displayed below.] Part 2 of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8203628e43_62966e8203585a4f.jpg)

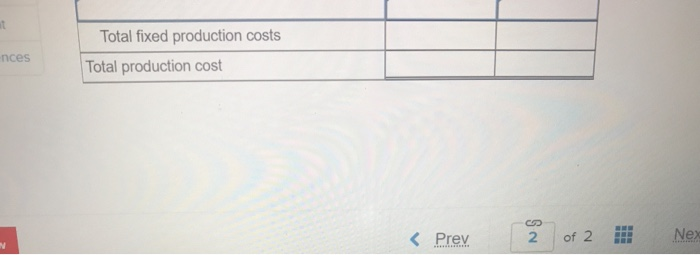

2 Problem 1-1A Cost computation, classification, and analysis LO C2, C3 The following information applies to the questions displayed below.] Part 2 of 2 Listed here are the total costs associated with the 2017 production of 1,000 drum sets manufactured by TrueBeat The drum sets sell for $562 each. 8 points Costs 1. Plastic for casing-$15,eee 2. Wages of assembly workers-$91,eee 3. Property taxes on factory-$7,886 4. Accounting staff salaries-$35,800 5. Drum stands (1,800 stands purchased)-$48,880 6. Rent cost of equipment for sales staff-$24,ee 7. Uppermanagement salaries-$215,eee 8. Annual flat fee for factory maintenance service-$16,800 9. Sales commissions-$24 per unit 10. Machinery depreciation, straight-line-544,80 Skipped eBook Ask Print References Problem 1-1A Part 2 2. Calculate the manufacturing cost per drum set. 2. Calculate the manufacturing cost per drum set. Part 2 of 2 TrueBeat Calculation of Manufacturing Cost per Drum Set For Year Ended December 31, 2017 8 points Item Total cost Per unit cost Skipped Variable production costs eBook Ask Print References Total variable production costs rencFixed production cosis Total fixed production costs Mc Graw Hill K Prev of 2 2 Total fixed production costs Total production cost nces Prev i Nex

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts