Question: 2 Problem 2 Mortgage Question Suppose Jon enters a $200,000 30 year mortgage agree- ment at a (real) interest of 2.5%. What is Jon's monthly

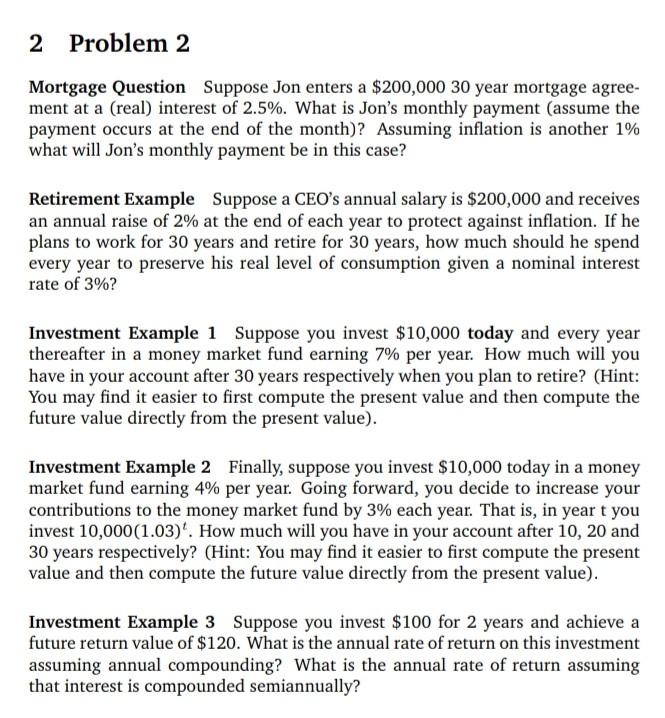

2 Problem 2 Mortgage Question Suppose Jon enters a $200,000 30 year mortgage agree- ment at a (real) interest of 2.5%. What is Jon's monthly payment (assume the payment occurs at the end of the month)? Assuming inflation is another 1% what will Jon's monthly payment be in this case? Retirement Example Suppose a CEO's annual salary is $200,000 and receives an annual raise of 2% at the end of each year to protect against inflation. If he plans to work for 30 years and retire for 30 years, how much should he spend every year to preserve his real level of consumption given a nominal interest rate of 3%? Investment Example 1 Suppose you invest $10,000 today and every year thereafter in a money market fund earning 7% per year. How much will you have in your account after 30 years respectively when you plan to retire? (Hint: You may find it easier to first compute the present value and then compute the future value directly from the present value). Investment Example 2 Finally, suppose you invest $10,000 today in a money market fund earning 4% per year. Going forward, you decide to increase your contributions to the money market fund by 3% each year. That is, in year t you invest 10,000(1.03)'. How much will you have in your account after 10, 20 and 30 years respectively? (Hint: You may find it easier to first compute the present value and then compute the future value directly from the present value). Investment Example 3 Suppose you invest $100 for 2 years and achieve a future return value of $120. What is the annual rate of return on this investment assuming annual compounding? What is the annual rate of return assuming that interest is compounded semiannually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts