Question: 2 Problem 25-2 Futures Quotes 0.07 points Suppose you sell six May 2018 silver futures contracts on March 27, 2018, at the last price of

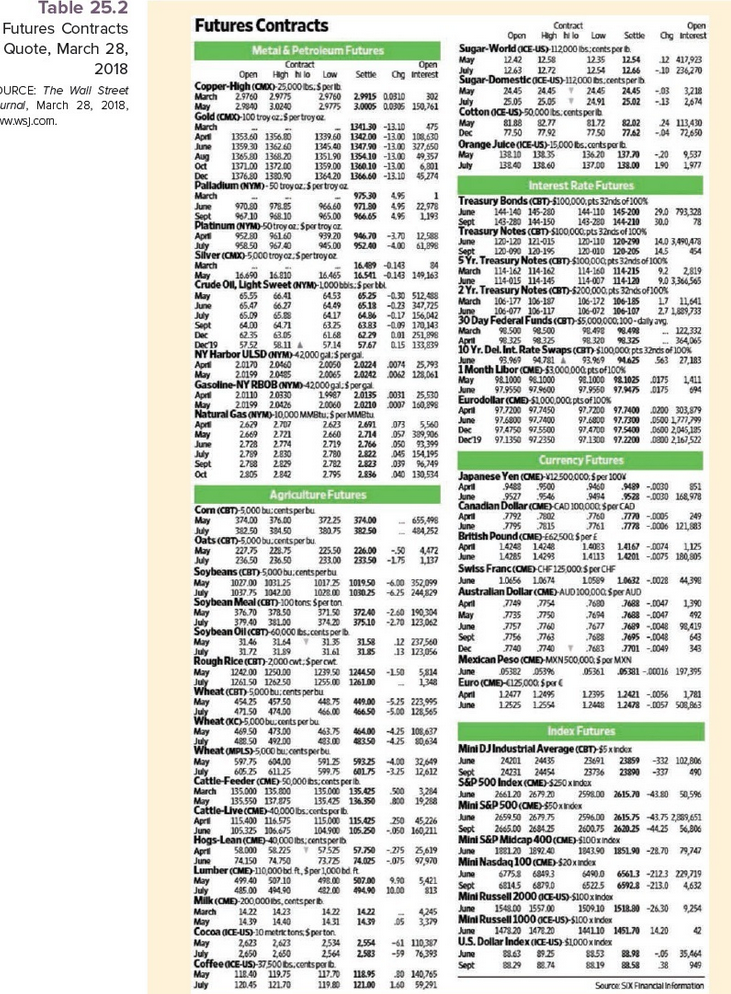

2 Problem 25-2 Futures Quotes 0.07 points Suppose you sell six May 2018 silver futures contracts on March 27, 2018, at the last price of the day. Use Table 25.2 a. What will your profit or loss be if silver prices turn out to be $16.72 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What will your profit or loss be if silver prices are $16.29 per ounce at expiration? (Enter your answer as a positive value. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) eBook Print a. Net loss b. Net gain References Futures Contracts Metal & Petrol Table 25.2 Futures Contracts Quote, March ch 28, 2018 OURCE: The Wall Street urnal, March 28, 2018, Ww.wsj.com 145.200 200 120-20 14.0 3.990 14715 106-072 106-107 $$$ 399$32 33 888888 98.320 98.3 080478193.969 965 SSAAN &SSSSS NNNN NN m-2006 June 1.000 1.0074 1925 Mexican Peso 0520 EuroCME-CIZS000 Spa June 12525 124 13 101-0056 1.78 -4,00 32,649 50 3:284 Industrial Average (CT 2001 24435 S&P 500 Index 255 23890-337 June 2661.20 2679.20 2008 215.0 43.80 50,5% Mini S&P 500 (OME) $50 W X 240079 620 11 Mini S&P Midcap 400(OME) $100x 1872 18439 67758 68493 401 6561.3 -2123 229,715 Sept. 581456879.0 65225 6592.3 -213.0 4632 1652 1600 10151221-2430254 Mind Russell 1000 CE-US>SIO Inde US Dollar Index CICE-US) $1000 x Inde 1451.70 14.20 2.83 09.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts