Question: 2. Problem 9-02 (AFN Equation) eBook Problem Walk-Through AFN equation Broussard Skateboard's sales are expected to increase by 15% from $8.6 million in 2018 to

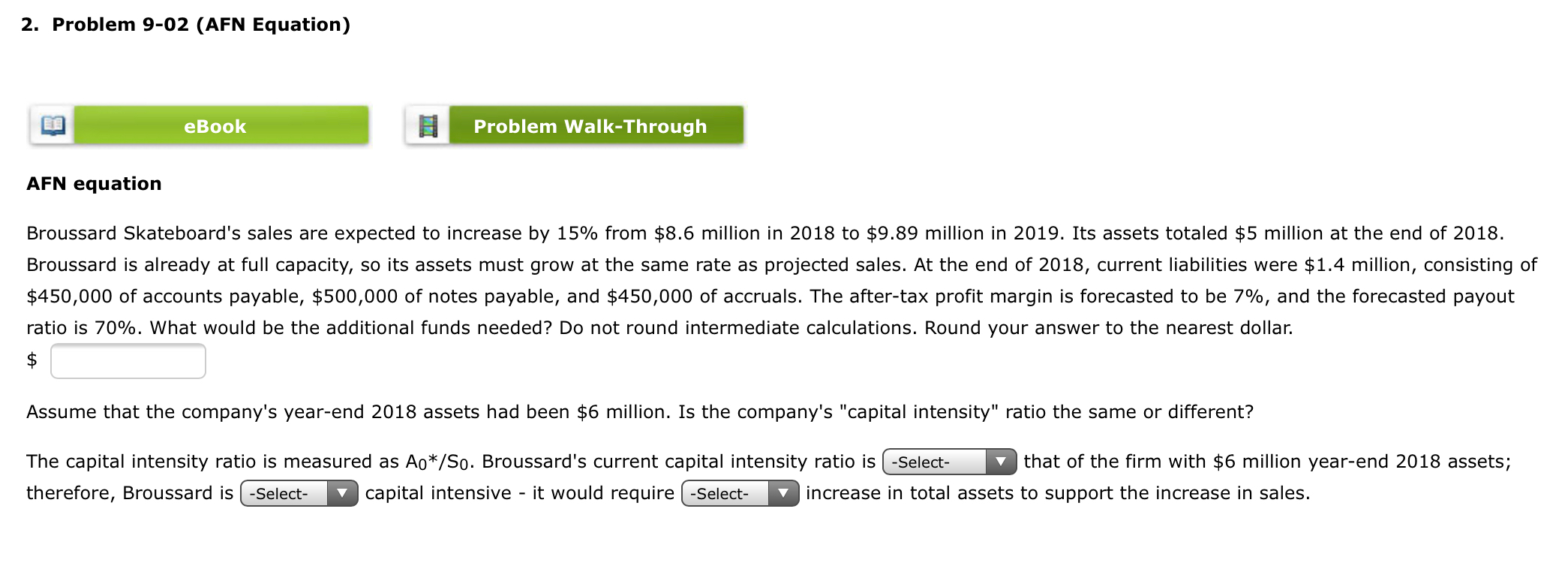

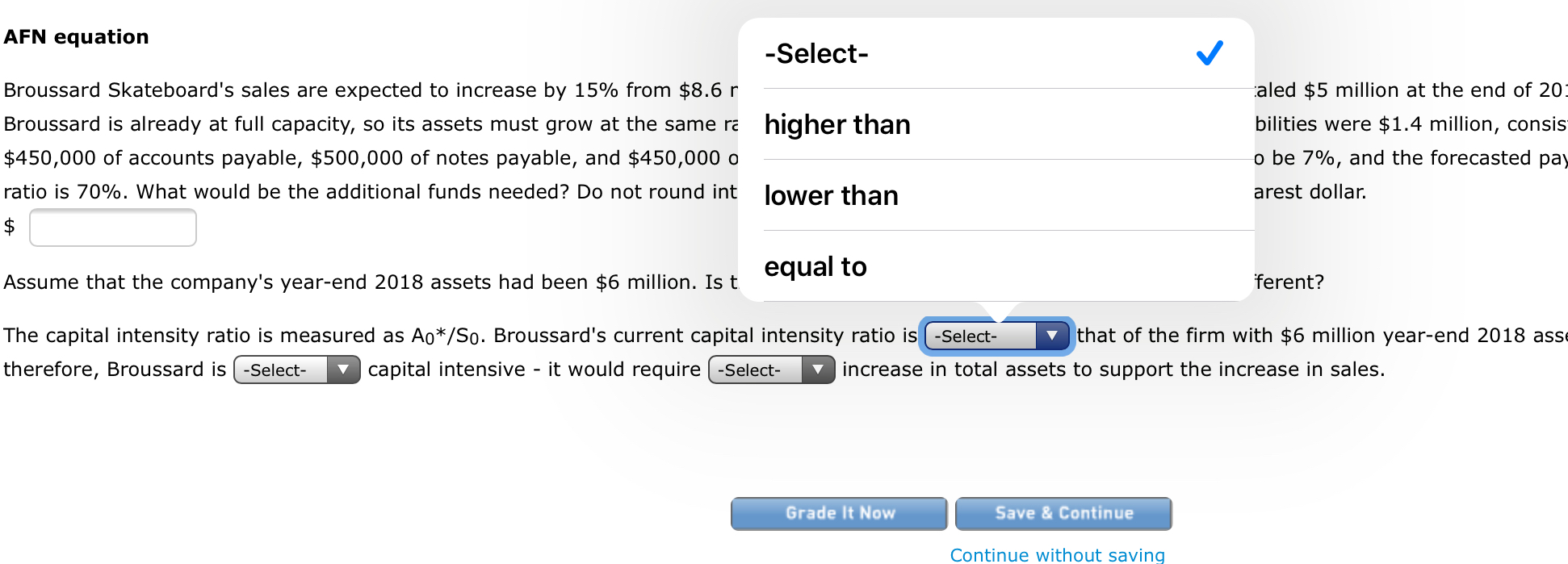

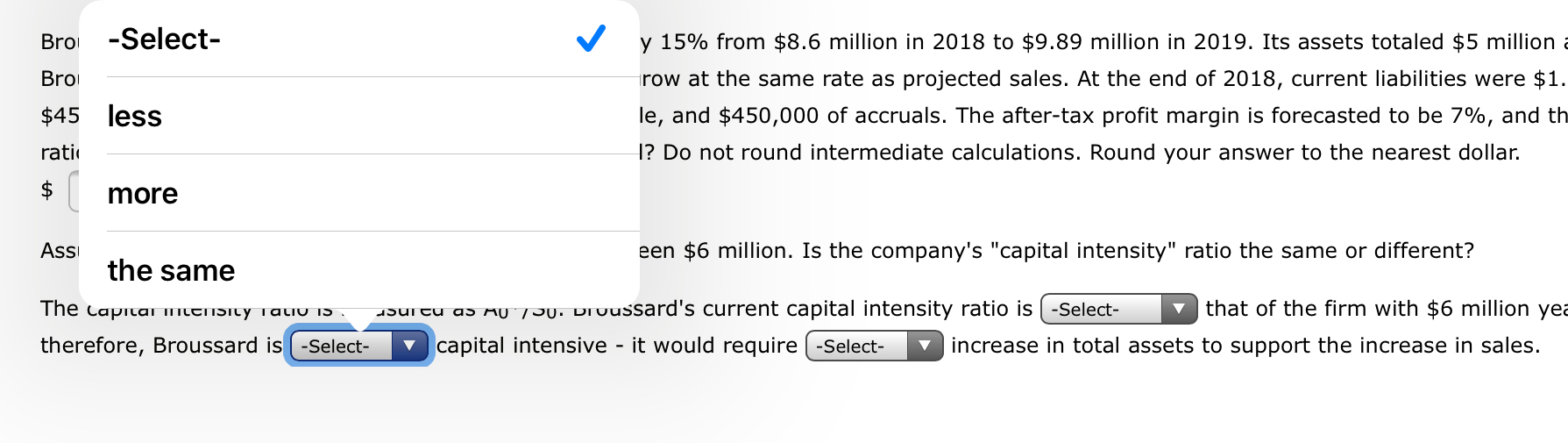

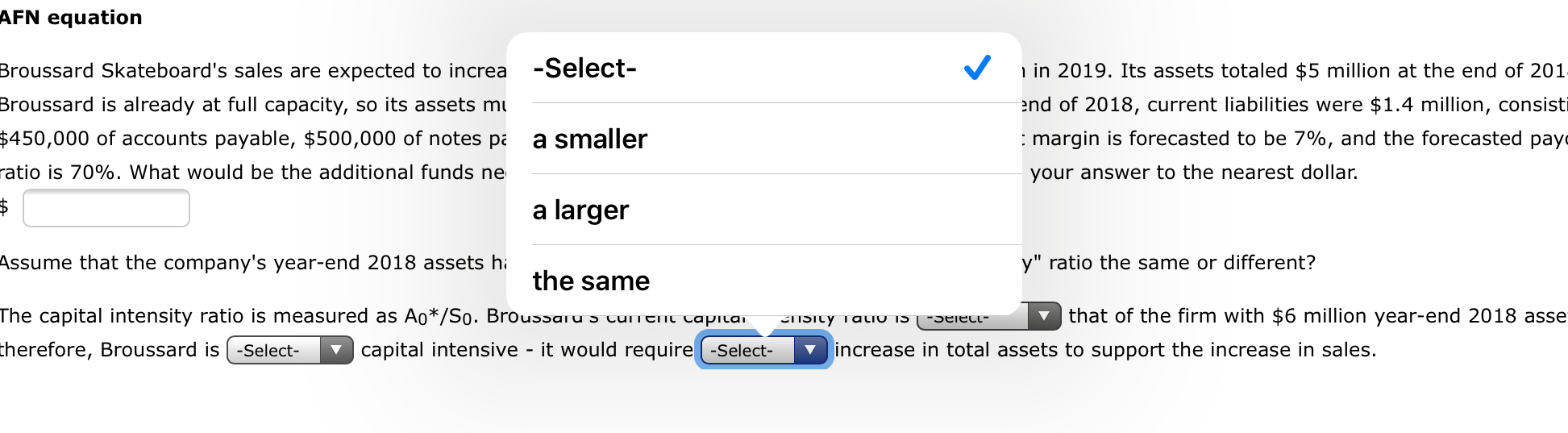

2. Problem 9-02 (AFN Equation) eBook Problem Walk-Through AFN equation Broussard Skateboard's sales are expected to increase by 15% from $8.6 million in 2018 to $9.89 million in 2019. Its assets totaled $5 million at the end of 2018. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 7%, and the forecasted payout ratio is 70%. What would be the additional funds needed? Do not round intermediate calculations. Round your answer to the nearest dollar. Assume that the company's year-end 2018 assets had been $6 million. Is the company's "capital intensity" ratio the same or different? The capital intensity ratio is measured as Ao*/So. Broussard's current capital intensity ratio is ( -Select- that of the firm with $6 million year-end 2018 assets; therefore, Broussard is ( -Select- capital intensive - it would require ( -Select- increase in total assets to support the increase in sales. AFN equation -Select- Broussard Skateboard's sales are expected to increase by 15% from $8.6 r. Broussard is already at full capacity, so its assets must grow at the same ra higher than $450,000 of accounts payable, $500,000 of notes payable, and $450,000 o ratio is 70%. What would be the additional funds needed? Do not round int lower than aled $5 million at the end of 20 bilities were $1.4 million, consis o be 7%, and the forecasted pay arest dollar. Assume that the company's year-end 2018 assets had been $6 million. Isto equal to ferent? The capital intensity ratio is measured as Ao*/So. Broussard's current capital intensity ratio is ( -Select- that of the firm with $6 million year-end 2018 asse therefore, Broussard is -Select- capital intensive - it would require -Select- increase in total assets to support the increase in sales. Grade It Now Save & Continue Continue without saving Bro -Select- Broi $45 less rati $ more y 15% from $8.6 million in 2018 to $9.89 million in 2019. Its assets totaled $5 million a row at the same rate as projected sales. At the end of 2018, current liabilities were $1. le, and $450,000 of accruals. The after-tax profit margin is forecasted to be 7%, and th 1? Do not round intermediate calculations. Round your answer to the nearest dollar. een $6 million. Is the company's "capital intensity" ratio the same or different? Assi the same The Capital ITEITSILY TALIO 13. therefore, Broussard is -Select- urtu ad MUPU. Druussard's current capital intensity ratio is ( -Select- that of the firm with $6 million yea capital intensive - it would require -Select- increase in total assets to support the increase in sales. AFN equation Broussard Skateboard's sales are expected to increa -Select- Broussard is already at full capacity, so its assets mu $450,000 of accounts payable, $500,000 of notes pc a smaller ratio is 70%. What would be the additional funds ne a larger i in 2019. Its assets totaled $5 million at the end of 201 end of 2018, current liabilities were $1.4 million, consist : margin is forecasted to be 7%, and the forecasted pay your answer to the nearest dollar. $ y" ratio the same or different? Assume that the company's year-end 2018 assets hi the same The capital intensity ratio is measured as Ao*/So. Broussaru > current capitan therefore, Broussard is ( -Select- capital intensive - it would require (-Select- ISILY TALIO 19 Deleu- that of the firm with $6 million year-end 2018 asse increase in total assets to support the increase in sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts