Question: 2. PROJECT EVALUATION (25 MARKS) Pittsburgh Ltd. is looking at replacing its old and relatively inefficient production equipment with new technology. The new equipment will

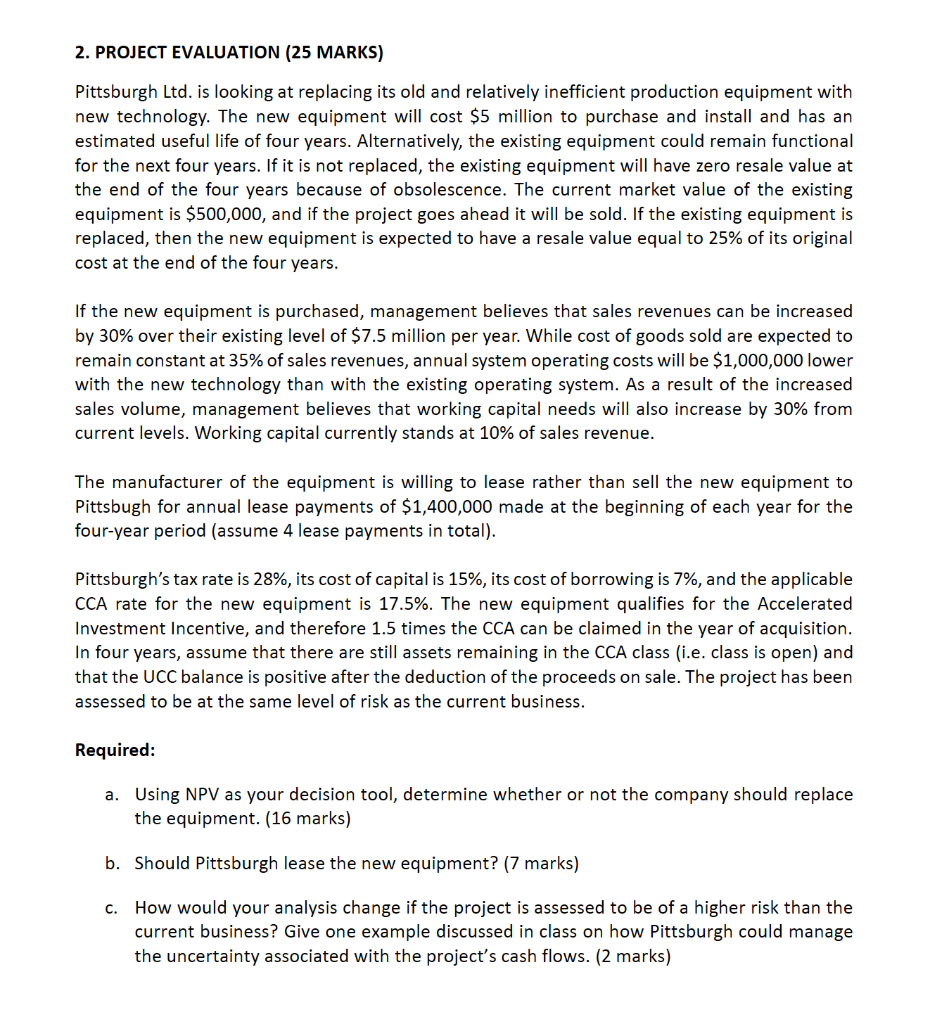

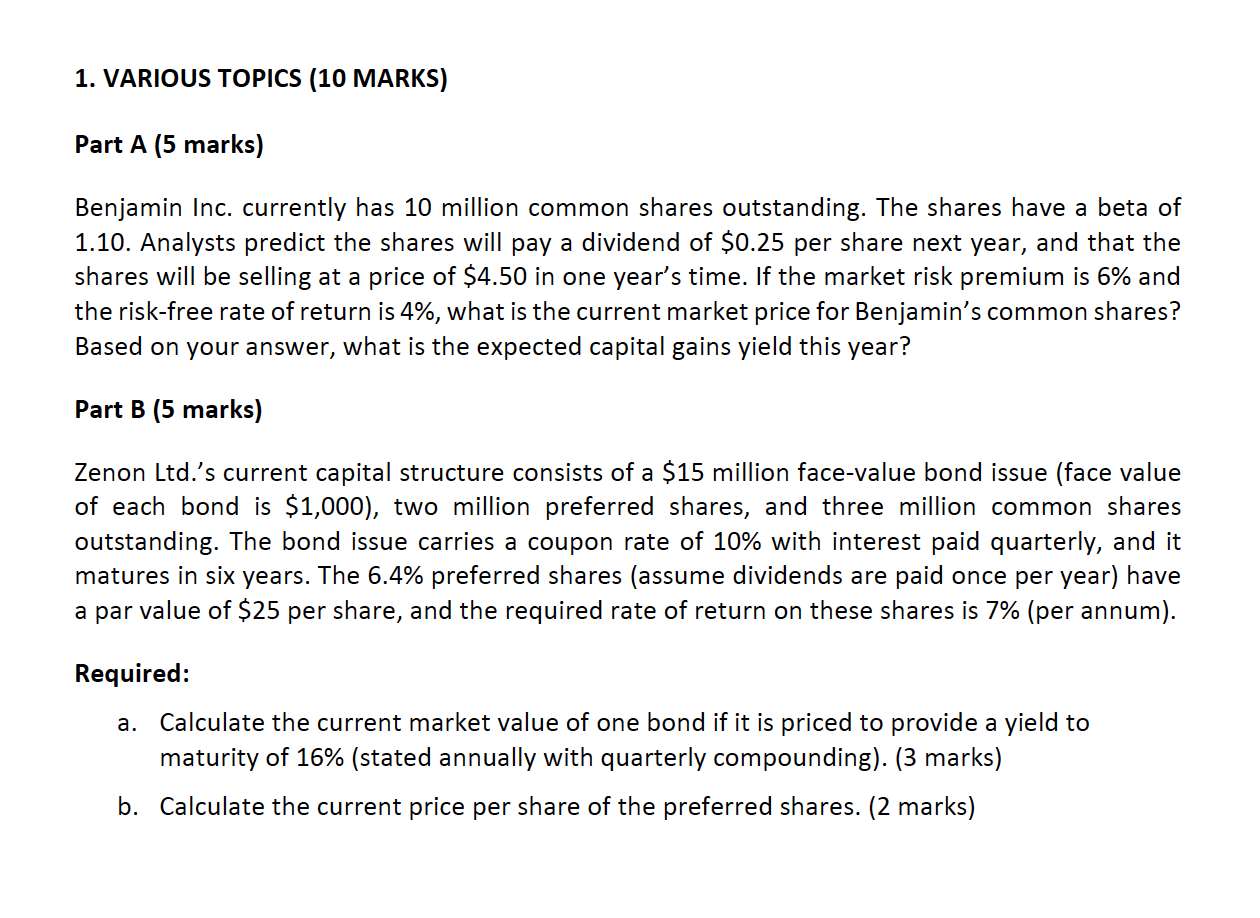

2. PROJECT EVALUATION (25 MARKS) Pittsburgh Ltd. is looking at replacing its old and relatively inefficient production equipment with new technology. The new equipment will cost $5 million to purchase and install and has an estimated useful life of four years. Alternatively, the existing equipment could remain functional for the next four years. If it is not replaced, the existing equipment will have zero resale value at the end of the four years because of obsolescence. The current market value of the existing equipment is $500,000, and if the project goes ahead it will be sold. If the existing equipment is replaced, then the new equipment is expected to have a resale value equal to 25% of its original cost at the end of the four years. If the new equipment is purchased, management believes that sales revenues can be increased by 30% over their existing level of $7.5 million per year. While cost of goods sold are expected to remain constant at 35% of sales revenues, annual system operating costs will be $1,000,000 lower with the new technology than with the existing operating system. As a result of the increased sales volume, management believes that working capital needs will also increase by 30% from current levels. Working capital currently stands at 10% of sales revenue. The manufacturer of the equipment is willing to lease rather than sell the new equipment to Pittsbugh for annual lease payments of $1,400,000 made at the beginning of each year for the four-year period (assume 4 lease payments in total). Pittsburgh's tax rate is 28%, its cost of capital is 15%, its cost of borrowing is 7%, and the applicable CCA rate for the new equipment is 17.5%. The new equipment qualifies for the Accelerated Investment Incentive, and therefore 1.5 times the CCA can be claimed in the year of acquisition. In four years, assume that there are still assets remaining in the CCA class (i.e. class is open) and that the UCC balance is positive after the deduction of the proceeds on sale. The project has been assessed to be at the same level of risk as the current business. Required: a. Using NPV as your decision tool, determine whether or not the company should replace the equipment. (16 marks) b. Should Pittsburgh lease the new equipment? (7 marks) c. How would your analysis change if the project is assessed to be of a higher risk than the current business? Give one example discussed in class on how Pittsburgh could manage the uncertainty associated with the project's cash flows. (2 marks) 1. VARIOUS TOPICS (10 MARKS) Part A (5 marks) Benjamin Inc. currently has 10 million common shares outstanding. The shares have a beta of 1.10. Analysts predict the shares will pay a dividend of $0.25 per share next year, and that the shares will be selling at a price of $4.50 in one year's time. If the market risk premium is 6% and the risk-free rate of return is 4%, what is the current market price for Benjamin's common shares? Based on your answer, what is the expected capital gains yield this year? Part B (5 marks) Zenon Ltd.'s current capital structure consists of a $15 million face-value bond issue (face value of each bond is $1,000), two million preferred shares, and three million common shares outstanding. The bond issue carries a coupon rate of 10% with interest paid quarterly, and it matures in six years. The 6.4% preferred shares (assume dividends are paid once per year) have a par value of $25 per share, and the required rate of return on these shares is 7% (per annum). Required: a. Calculate the current market value of one bond if it is priced to provide a yield to maturity of 16% (stated annually with quarterly compounding). (3 marks) b. Calculate the current price per share of the preferred shares. (2 marks) 2. PROJECT EVALUATION (25 MARKS) Pittsburgh Ltd. is looking at replacing its old and relatively inefficient production equipment with new technology. The new equipment will cost $5 million to purchase and install and has an estimated useful life of four years. Alternatively, the existing equipment could remain functional for the next four years. If it is not replaced, the existing equipment will have zero resale value at the end of the four years because of obsolescence. The current market value of the existing equipment is $500,000, and if the project goes ahead it will be sold. If the existing equipment is replaced, then the new equipment is expected to have a resale value equal to 25% of its original cost at the end of the four years. If the new equipment is purchased, management believes that sales revenues can be increased by 30% over their existing level of $7.5 million per year. While cost of goods sold are expected to remain constant at 35% of sales revenues, annual system operating costs will be $1,000,000 lower with the new technology than with the existing operating system. As a result of the increased sales volume, management believes that working capital needs will also increase by 30% from current levels. Working capital currently stands at 10% of sales revenue. The manufacturer of the equipment is willing to lease rather than sell the new equipment to Pittsbugh for annual lease payments of $1,400,000 made at the beginning of each year for the four-year period (assume 4 lease payments in total). Pittsburgh's tax rate is 28%, its cost of capital is 15%, its cost of borrowing is 7%, and the applicable CCA rate for the new equipment is 17.5%. The new equipment qualifies for the Accelerated Investment Incentive, and therefore 1.5 times the CCA can be claimed in the year of acquisition. In four years, assume that there are still assets remaining in the CCA class (i.e. class is open) and that the UCC balance is positive after the deduction of the proceeds on sale. The project has been assessed to be at the same level of risk as the current business. Required: a. Using NPV as your decision tool, determine whether or not the company should replace the equipment. (16 marks) b. Should Pittsburgh lease the new equipment? (7 marks) c. How would your analysis change if the project is assessed to be of a higher risk than the current business? Give one example discussed in class on how Pittsburgh could manage the uncertainty associated with the project's cash flows. (2 marks) 1. VARIOUS TOPICS (10 MARKS) Part A (5 marks) Benjamin Inc. currently has 10 million common shares outstanding. The shares have a beta of 1.10. Analysts predict the shares will pay a dividend of $0.25 per share next year, and that the shares will be selling at a price of $4.50 in one year's time. If the market risk premium is 6% and the risk-free rate of return is 4%, what is the current market price for Benjamin's common shares? Based on your answer, what is the expected capital gains yield this year? Part B (5 marks) Zenon Ltd.'s current capital structure consists of a $15 million face-value bond issue (face value of each bond is $1,000), two million preferred shares, and three million common shares outstanding. The bond issue carries a coupon rate of 10% with interest paid quarterly, and it matures in six years. The 6.4% preferred shares (assume dividends are paid once per year) have a par value of $25 per share, and the required rate of return on these shares is 7% (per annum). Required: a. Calculate the current market value of one bond if it is priced to provide a yield to maturity of 16% (stated annually with quarterly compounding). (3 marks) b. Calculate the current price per share of the preferred shares. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts