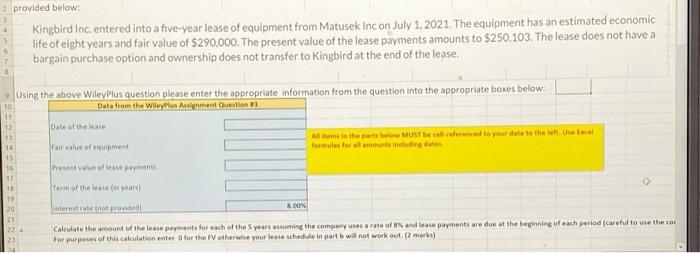

Question: 2 provided below: Kingbird Inc entered into a five-year lease of equipment from Matusek Inc on July 1, 2021. The equipment has an estimated economic

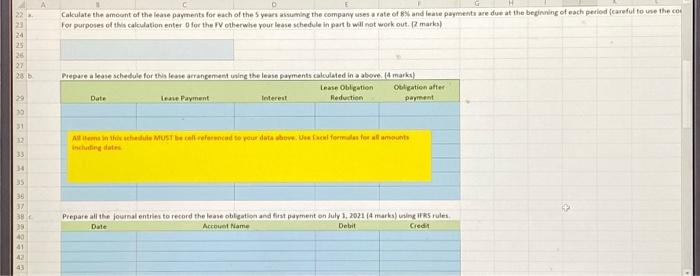

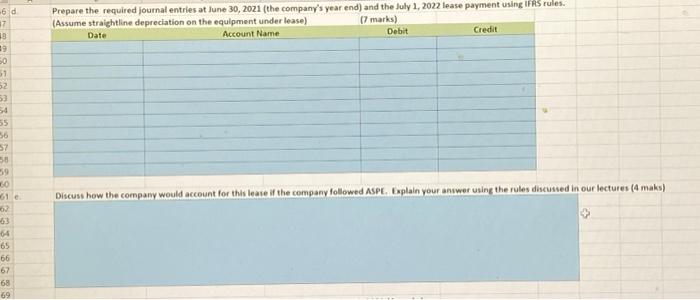

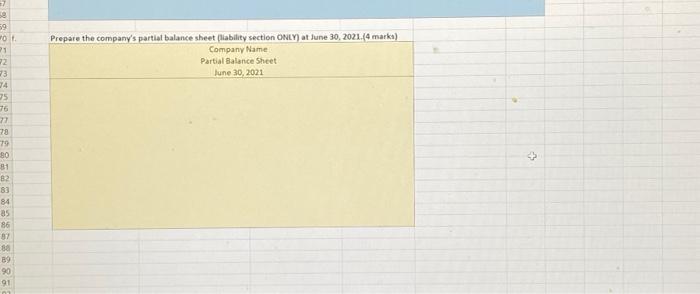

2 provided below: Kingbird Inc entered into a five-year lease of equipment from Matusek Inc on July 1, 2021. The equipment has an estimated economic life of eight years and fair value of $290,000. The present value of the lease payments amounts to $250,103. The lease does not have a bargain purchase option and ownership does not transfer to Kingbird at the end of the lease. 4 5 5 7 Using the above Wileyplus question please enter the appropriate information from the question into the appropriate boxes below Data from the WileyPlus Anment Ouestion 3 10 11 12 Date of the late All items in the parts MUST be conced te your dute to the lente nel formules for sit amet including dates Fair value nequipment 14 15 16 Present you use payment Term of the case in year 1 10 20 20 Interest rate (not provided) 8.00 Calculate the amount of the lease payments for each of the 5 years asuming the company uses a rate of and lease payments are due at the beginning of each period careful to use the co For purposes of this calculation enter for the otherwise your are schedule in part will not work out marks) 23 22 Calculate the amount of the lease payments for each of the years in the company uses a rate of and leave payments are due at the beginning of each period careful to use the co for purposes of this calculation enter for the IV otherwhe your lease schedule in parth will not work out.2 marka) 14 22 25 27 230 Prepare alle schedule for this lease aangemantuning the lease payments calculated in a above markt Lease Obligation Obligation after Dute Inne Payment Interest Reduction payment 31 Al terme in the schedule MUST BE ferrocad to your data show, we faci formadas for all mounts 33 34 35 Prepare all the journal entries to record the lease obligation and first payment on July 1, 2021 (4 marka) using its rules Date Account Name Debit Credit 40 41 43 Prepare the required journal entries at June 30, 2021 (the company's year end) and the July 1, 2022 lease payment using IFRS rules. (Assume straightline depreciation on the equipment under lease) (7 marks) Date Account Name Debit Credit -6d 7 13 9 50 51 52 53 54 55 56 57 58 59 60 61 Discuss how the company would account for this lease of the company followed ASPE. Explain your answer using the rules discussed in our lectures (4 maks) -63 04 65 66 67 68 69 Prepare the company's partial balance sheet (lability section ONLY) at June 30, 2021.4 marks) Company Name Partial Balance Sheet June 30,2021 e 59 0 21 22 13 4 75 76 77 78 79 30 1 82 83 84 85 86 57 -- 90 91 2 provided below: Kingbird Inc entered into a five-year lease of equipment from Matusek Inc on July 1, 2021. The equipment has an estimated economic life of eight years and fair value of $290,000. The present value of the lease payments amounts to $250,103. The lease does not have a bargain purchase option and ownership does not transfer to Kingbird at the end of the lease. 4 5 5 7 Using the above Wileyplus question please enter the appropriate information from the question into the appropriate boxes below Data from the WileyPlus Anment Ouestion 3 10 11 12 Date of the late All items in the parts MUST be conced te your dute to the lente nel formules for sit amet including dates Fair value nequipment 14 15 16 Present you use payment Term of the case in year 1 10 20 20 Interest rate (not provided) 8.00 Calculate the amount of the lease payments for each of the 5 years asuming the company uses a rate of and lease payments are due at the beginning of each period careful to use the co For purposes of this calculation enter for the otherwise your are schedule in part will not work out marks) 23 22 Calculate the amount of the lease payments for each of the years in the company uses a rate of and leave payments are due at the beginning of each period careful to use the co for purposes of this calculation enter for the IV otherwhe your lease schedule in parth will not work out.2 marka) 14 22 25 27 230 Prepare alle schedule for this lease aangemantuning the lease payments calculated in a above markt Lease Obligation Obligation after Dute Inne Payment Interest Reduction payment 31 Al terme in the schedule MUST BE ferrocad to your data show, we faci formadas for all mounts 33 34 35 Prepare all the journal entries to record the lease obligation and first payment on July 1, 2021 (4 marka) using its rules Date Account Name Debit Credit 40 41 43 Prepare the required journal entries at June 30, 2021 (the company's year end) and the July 1, 2022 lease payment using IFRS rules. (Assume straightline depreciation on the equipment under lease) (7 marks) Date Account Name Debit Credit -6d 7 13 9 50 51 52 53 54 55 56 57 58 59 60 61 Discuss how the company would account for this lease of the company followed ASPE. Explain your answer using the rules discussed in our lectures (4 maks) -63 04 65 66 67 68 69 Prepare the company's partial balance sheet (lability section ONLY) at June 30, 2021.4 marks) Company Name Partial Balance Sheet June 30,2021 e 59 0 21 22 13 4 75 76 77 78 79 30 1 82 83 84 85 86 57 -- 90 91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts