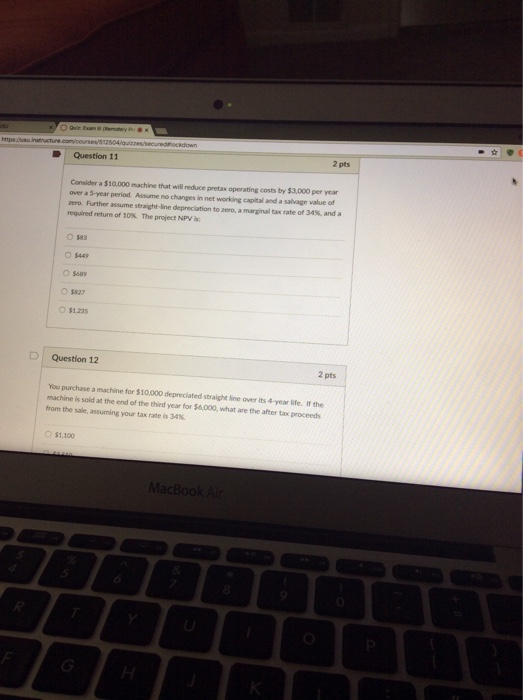

Question: 2 pts Question 11 Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over a 5-year period. Assume no changes

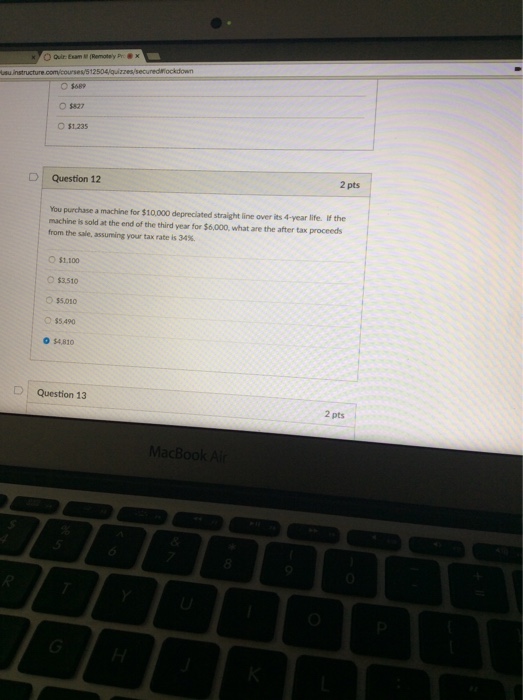

2 pts Question 11 Consider a $10,000 machine that will reduce pretax operating costs by $3,000 per year over a 5-year period. Assume no changes in net working capital and a salvage value of zero Father assume sera ght-line depreciation to zero, a marginal tax rate of 34%, and a required return of 10% The project NPV is: O $449 ? $827 $1.235 D Question 12 2 pts a machine for $10,000 deprecilated straight line over its 4-year life. If the machine is sold at the end of the third year for $6,000, what are the after tax proceeds from the sale, assuming your tax rate is 34 $1,100 MacBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts