Question: 2 pts Question 4 Johnson & Johnson has an ROIC of 25% and a weighted average cost of capital of 9%. The company is considering

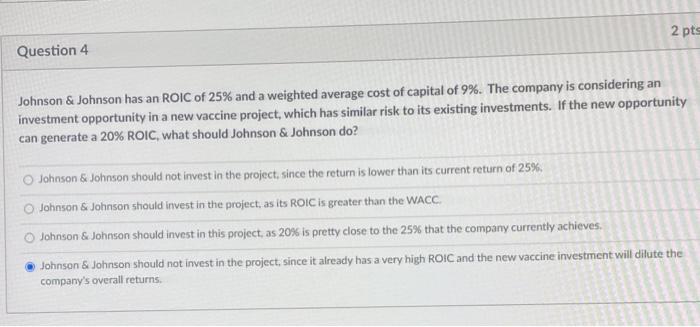

2 pts Question 4 Johnson & Johnson has an ROIC of 25% and a weighted average cost of capital of 9%. The company is considering an investment opportunity in a new vaccine project, which has similar risk to its existing investments. If the new opportunity can generate a 20% ROIC, what should Johnson & Johnson do? Johnson & Johnson should not invest in the project since the return is lower than its current return of 25%. Johnson & Johnson should invest in the project, as its ROIC is greater than the WACC. Johnson & Johnson should invest in this project, as 20% is pretty close to the 25% that the company currently achieves. Johnson & Johnson should not invest in the project, since it already has a very high ROIC and the new vaccine investment will dilute the company's overall returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts