Question: 2 Question 2 (1 point) Lila Rodgers is a single custodial parent with a 6 year old son. She pays $4,000 per year for part-time

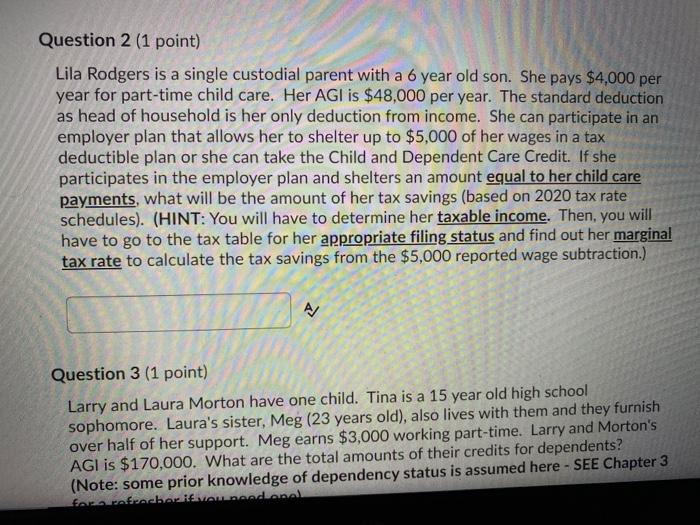

Question 2 (1 point) Lila Rodgers is a single custodial parent with a 6 year old son. She pays $4,000 per year for part-time child care. Her AGI is $48,000 per year. The standard deduction as head of household is her only deduction from income. She can participate in an employer plan that allows her to shelter up to $5,000 of her wages in a tax deductible plan or she can take the Child and Dependent Care Credit. If she participates in the employer plan and shelters an amount equal to her child care payments, what will be the amount of her tax savings (based on 2020 tax rate schedules). (HINT: You will have to determine her taxable income. Then, you will have to go to the tax table for her appropriate filing status and find out her marginal tax rate to calculate the tax savings from the $5,000 reported wage subtraction.) Question 3 (1 point) Larry and Laura Morton have one child. Tina is a 15 year old high school sophomore. Laura's sister, Meg (23 years old), also lives with them and they furnish over half of her support. Meg earns $3,000 working part-time. Larry and Morton's AGI is $170,000. What are the total amounts of their credits for dependents? (Note: some prior knowledge of dependency status is assumed here - SEE Chapter 3 faze rafrecharivaunandanal Question 2 (1 point) Lila Rodgers is a single custodial parent with a 6 year old son. She pays $4,000 per year for part-time child care. Her AGI is $48,000 per year. The standard deduction as head of household is her only deduction from income. She can participate in an employer plan that allows her to shelter up to $5,000 of her wages in a tax deductible plan or she can take the Child and Dependent Care Credit. If she participates in the employer plan and shelters an amount equal to her child care payments, what will be the amount of her tax savings (based on 2020 tax rate schedules). (HINT: You will have to determine her taxable income. Then, you will have to go to the tax table for her appropriate filing status and find out her marginal tax rate to calculate the tax savings from the $5,000 reported wage subtraction.) Question 3 (1 point) Larry and Laura Morton have one child. Tina is a 15 year old high school sophomore. Laura's sister, Meg (23 years old), also lives with them and they furnish over half of her support. Meg earns $3,000 working part-time. Larry and Morton's AGI is $170,000. What are the total amounts of their credits for dependents? (Note: some prior knowledge of dependency status is assumed here - SEE Chapter 3 faze rafrecharivaunandanal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts