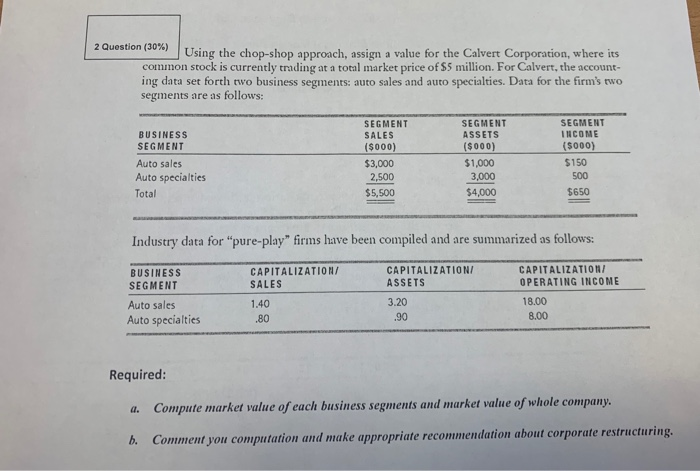

Question: 2 Question (30%) | Using the chop-shop approach, assign a value for the Calvert Corporation, where its common stock is currently trading at a total

2 Question (30%) | Using the chop-shop approach, assign a value for the Calvert Corporation, where its common stock is currently trading at a total market price of S5 million. For Calvert, the account- ing data set forth two business segments: auto sales and auto specialties. Data for the firm's two segments are as follows SEGMENT SALES ($000) $3,000 SEGMENT ASSETS ($000) $1,000 3,000 $4,000 SEGMENT NCOME (s000) $150 500 $650 BUSINESSs SEGMENT Auto sales Auto specialties Total 2,500 $5,500 Industry data for "pure-play" firms have been compiled and are summarized as follows: CAPITALIZATION CAPITALIZATION ASSETS CAPITALIZATIONI OPERATING INCOME BUSINESS SEGMENT Auto sales Auto specialties SALES 1.40 .80 3.20 18.00 .90 8.00 Required: a. Compute market value of each business segments and market value o whole company. b. Comment you computation and make appropriate recommendation about corporate restructuring

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts