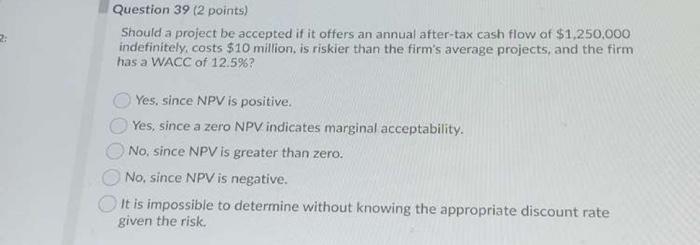

Question: 2 Question 39 (2 points) Should a project be accepted if it offers an annual after-tax cash flow of $1,250,000 indefinitely costs $10 million, is

2 Question 39 (2 points) Should a project be accepted if it offers an annual after-tax cash flow of $1,250,000 indefinitely costs $10 million, is riskier than the firm's average projects, and the firm has a WACC of 12.5%? Yes, since NPV is positive. Yes, since a zero NPV indicates marginal acceptability. No, since NPV is greater than zero. No, since NPV is negative. It is impossible to determine without knowing the appropriate discount rate given the risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts