Question: 2 questions 12. Valuing v ed stock Aa Aa E Companies that have preferred stock outstanding promise to pay a stated dividend for an infinite

2 questions

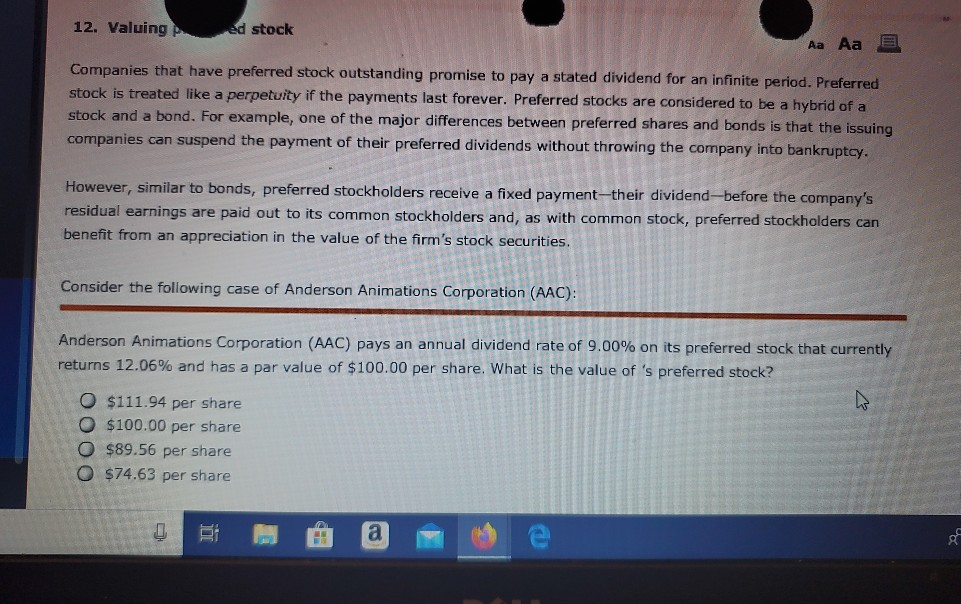

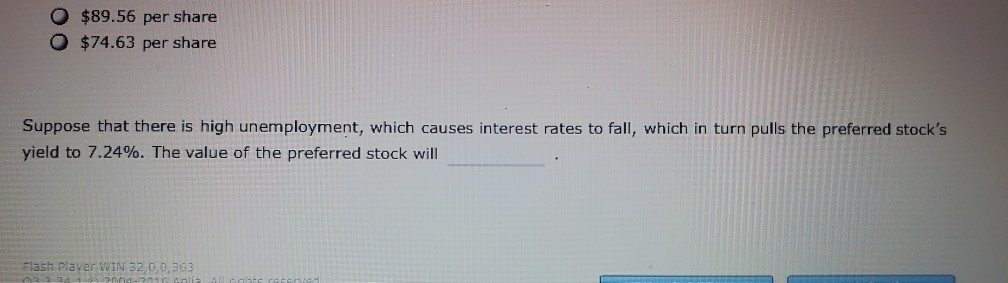

12. Valuing v ed stock Aa Aa E Companies that have preferred stock outstanding promise to pay a stated dividend for an infinite period. Preferred stock is treated like a perpetuity if the payments last forever. Preferred stocks are considered to be a hybrid of a stock and a bond. For example, one of the major differences between preferred shares and bonds is that the issuing companies can suspend the payment of their preferred dividends without throwing the company into bankruptcy. However, similar to bonds, preferred stockholders receive a fixed payment-their dividend-before the company's residual earnings are paid out to its common stockholders and, as with common stock, preferred stockholders can benefit from an appreciation in the value of the firm's stock securities. Consider the following case of Anderson Animations Corporation (AAC): Anderson Animations Corporation (AAC) pays an annual dividend rate of 9.00% on its preferred stock that currently returns 12.06% and has a par value of $100.00 per share. What is the value of 's preferred stock? O $111.94 per share O $100.00 per share O $89.56 per share $74.63 per share $89.56 per share $74.63 per share Suppose that there is high unemployment, which causes interest rates to fall, which in turn pulls the preferred stock's yield to 7.24%. The value of the preferred stock will Flash Player WIN 32,0,0.363 ons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts