Question: 2 questions please answer 6 and 7 Question 6 (1 point) The beta of M Simon Inc., stock is 1.8, whereas the risk free rate

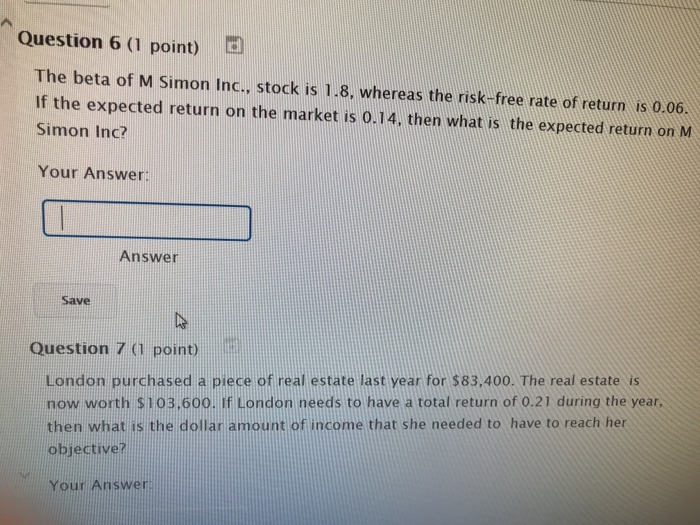

Question 6 (1 point) The beta of M Simon Inc., stock is 1.8, whereas the risk free rate of return is 0.06. If the expected return on the market is 0.14. then what is the expected return on M Simon Inc? Your Answer Answer Save Question 7 (1 point) London purchased a piece of real estate last vear for $83.400. The real estate is now worth s103.600. If London needs to have a total return of 0.21 during the year. then what is the dollar amount of income that she needed to have to reach her objective? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts