Question: (2) Ratio analysis & interpretation - work through practice Questions - (a) Western Trading plc, (b) 'Brenda', (c) 'Chelsea plc', (d) 'Ryetrend', (e) Greenwood', (f)

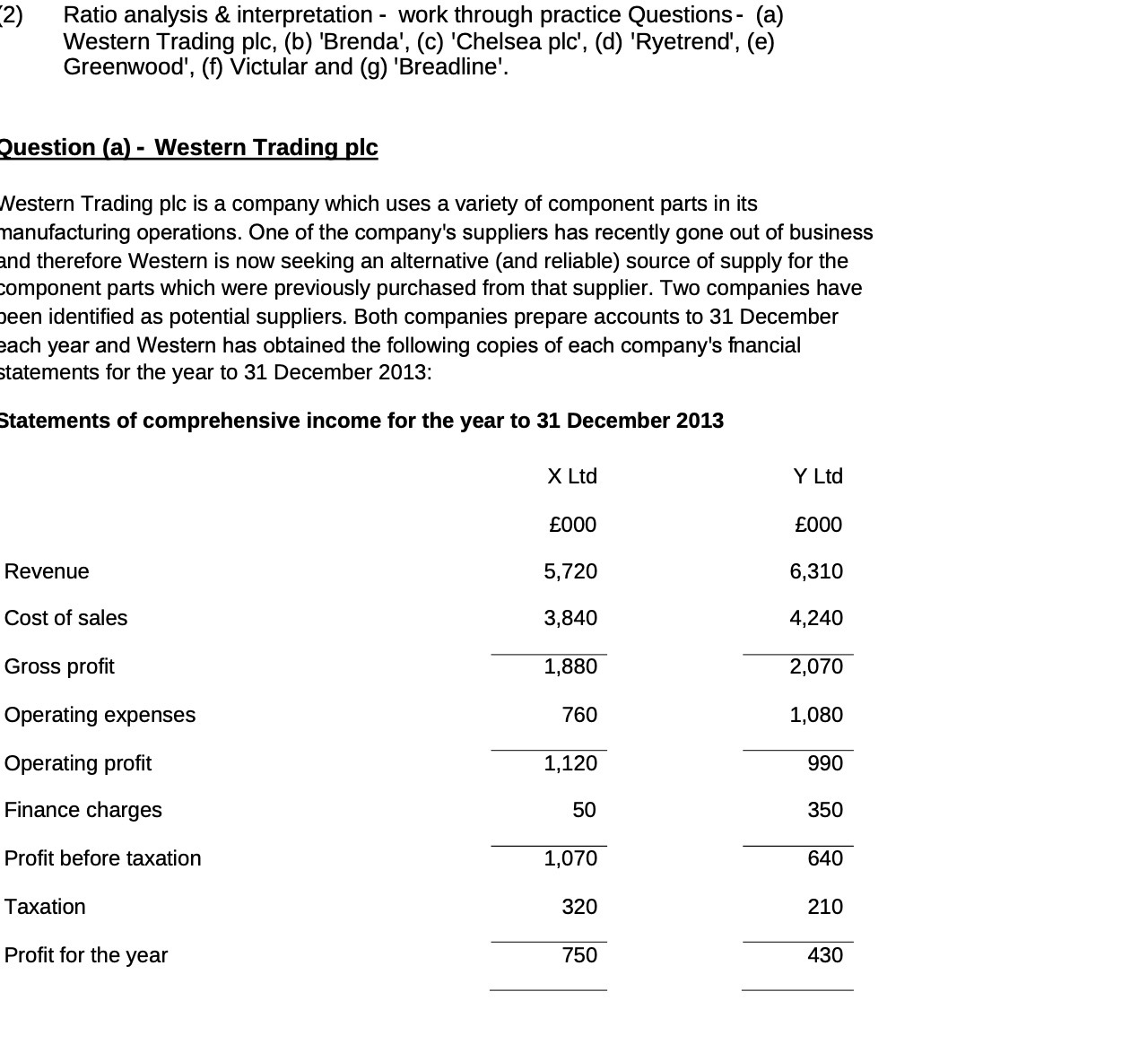

(2) Ratio analysis & interpretation - work through practice Questions - (a) Western Trading plc, (b) 'Brenda', (c) 'Chelsea plc', (d) 'Ryetrend', (e) Greenwood', (f) Victular and (g) 'Breadline'. Question (a) - Western Trading pic Western Trading plc is a company which uses a variety of component parts in its manufacturing operations. One of the company's suppliers has recently gone out of business and therefore Western is now seeking an alternative (and reliable) source of supply for the component parts which were previously purchased from that supplier. Two companies have been identified as potential suppliers. Both companies prepare accounts to 31 December each year and Western has obtained the following copies of each company's fnancial statements for the year to 31 December 2013: Statements of comprehensive income for the year to 31 December 2013 X Ltd Y Ltd EOOO EOOO Revenue 5,720 6,310 Cost of sales 3,840 4,240 Gross profit 1,880 2,070 Operating expenses 760 1,080 Operating profit 1,120 990 Finance charges 50 350 Profit before taxation 1,070 640 Taxation 320 210 Profit for the year 750 430

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts