Question: 2 ) Recording transactions and preparing financial statements question ( 4 0 points; 1 point for each journal entry, 1 point for each T account,

Recording transactions and preparing financial statements question points; point for each journal entry, point for each T account, and points for each of the income statement and the balance sheet

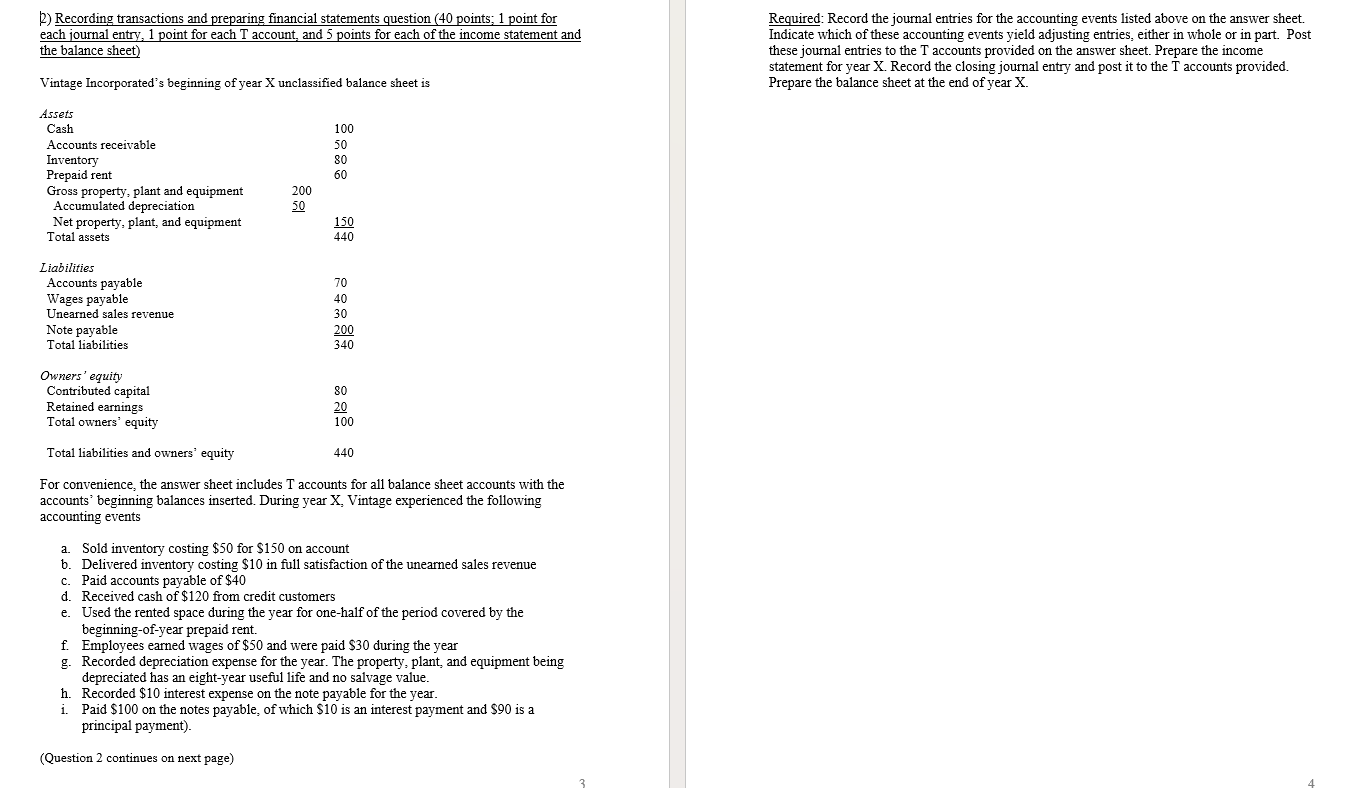

Vintage Incorporateds beginning of year X unclassified balance sheet is

Assets

Cash

Accounts receivable

Inventory

Prepaid rent

Gross property, plant and equipment

Accumulated depreciation

Net property, plant, and equipment

Total assets

Liabilities

Accounts payable

Wages payable

Unearned sales revenue

Note payable

Total liabilities

Owners equity

Contributed capital

Retained earnings

Total owners equity

Total liabilities and owners equity

For convenience, the answer sheet includes T accounts for all balance sheet accounts with the accounts beginning balances inserted. During year X Vintage experienced the following accounting events

a Sold inventory costing $ for $ on account

b Delivered inventory costing $ in full satisfaction of the unearned sales revenue

c Paid accounts payable of $

d Received cash of $ from credit customers

e Used the rented space during the year for onehalf of the period covered by the beginningofyear prepaid rent.

f Employees earned wages of $ and were paid $ during the year

g Recorded depreciation expense for the year. The property, plant, and equipment being depreciated has an eightyear useful life and no salvage value.

h Recorded $ interest expense on the note payable for the year.

i Paid $ on the notes payable, of which $ is an interest payment and $ is a principal payment

Question continues on next page

Required: Record the journal entries for the accounting events listed above on the answer sheet. Indicate which of these accounting events yield adjusting entries, either in whole or in part. Post these journal entries to the T accounts provided on the answer sheet. Prepare the income statement for year X Record the closing journal entry and post it to the T accounts provided. Prepare the balance sheet at the end of year X

Required: Record the journal entries for the accounting events listed above on the answer sheet. Indicate which of these accounting events yield adjusting entries, either in whole or in part. Post these journal entries to the T accounts provided on the answer sheet. Prepare the income statement for year X Record the closing journal entry and post it to the T accounts provided. Prepare the balance sheet at the end of year X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock