Question: 2. Recreate Exhibit 3.5 in excel sheet. List the formulas needed to create the sheet. B. Now recreate with a cost of living adjustment of

2. Recreate Exhibit 3.5 in excel sheet. List the formulas needed to create the sheet. B. Now recreate with a cost of living adjustment of 2%. C. Now assume that there are 3 captains, how might you adjust the sheet to reflect totals?

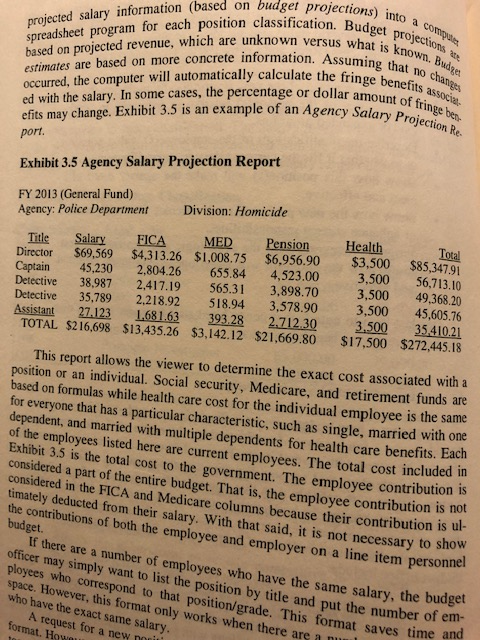

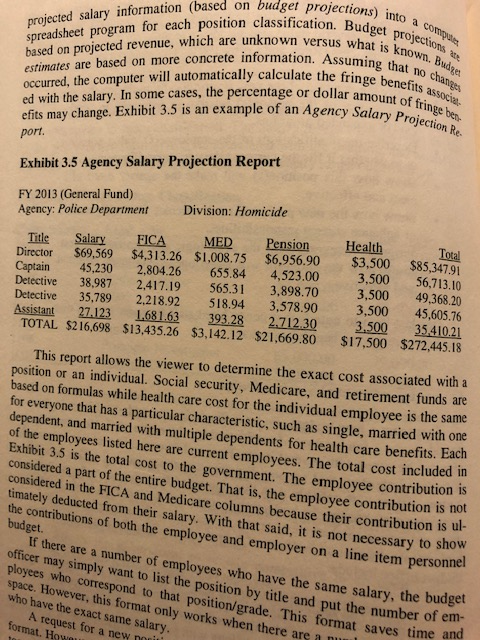

based on projected revenue, which are unknown versus what is known. Budga spreadsheet program for each position classification. Budget projections ar occurred, the computer will automatically calculate the fringe benefits associa ed with the salary. In some cases, the percentage or dollar amount of fringe bene projected salary information (based on budget projections) into a computer change Agency Salary Projection Re efits may change. Exhibit 3.5 is an example of an port Exhibit 3.5 Agency Salary Projection Report FY 2013 (General Fund) Agency: Police Department Division: Homicide Title Salary FICA MED Pension Director $69,569 $4,313.26 $1.008.75 $6.956.90 Captain 45,230 2.804.26 655.84 4,523.00 Detective 38,987 2,417.19 565.31 3.898.70 Detective 35,789 2.218.92 518.94 3,578.90 Assistant 27.123 1.681.63 393.28 2.712.30 TOTAL $216,698 $13,435.26 $3.142.12 $21,669.80 Health Total $3,500 $85,347.91 3.500 56,713.10 3,500 49,368.20 3.500 45,605.76 3.500 35.410.21 $17.500 $272.445.18 This report allows the viewer to determine the exact cost associated with a position or an individual. Social security, Medicare, and retirement funds are based on formulas while health care cost for the individual employee is the same for everyone that has a particular characteristic, such as single, married with one dependent, and married with multiple dependents for health care benefits. Each of the employees listed here are current employees. The total cost included in Exhibit 3.5 is the total cost to the government. The employee contribution is considered a part of the entire budget. That is, the employee contribution is not considered in the FICA and Medicare columns because their contribution is ul- timately deducted from their salary. With that said, it is not necessary to show the contributions of both the employee and employer on a line item personnel If there are a number of employees who have the same salary, the budget officer may simply want to list the position by title and put the number of em budget ployees who correspond to that position/grade. This format saves time and space. However, this format only works when there are a nu who have the exact same salary. A request for a new now format. Howow based on projected revenue, which are unknown versus what is known. Budga spreadsheet program for each position classification. Budget projections ar occurred, the computer will automatically calculate the fringe benefits associa ed with the salary. In some cases, the percentage or dollar amount of fringe bene projected salary information (based on budget projections) into a computer change Agency Salary Projection Re efits may change. Exhibit 3.5 is an example of an port Exhibit 3.5 Agency Salary Projection Report FY 2013 (General Fund) Agency: Police Department Division: Homicide Title Salary FICA MED Pension Director $69,569 $4,313.26 $1.008.75 $6.956.90 Captain 45,230 2.804.26 655.84 4,523.00 Detective 38,987 2,417.19 565.31 3.898.70 Detective 35,789 2.218.92 518.94 3,578.90 Assistant 27.123 1.681.63 393.28 2.712.30 TOTAL $216,698 $13,435.26 $3.142.12 $21,669.80 Health Total $3,500 $85,347.91 3.500 56,713.10 3,500 49,368.20 3.500 45,605.76 3.500 35.410.21 $17.500 $272.445.18 This report allows the viewer to determine the exact cost associated with a position or an individual. Social security, Medicare, and retirement funds are based on formulas while health care cost for the individual employee is the same for everyone that has a particular characteristic, such as single, married with one dependent, and married with multiple dependents for health care benefits. Each of the employees listed here are current employees. The total cost included in Exhibit 3.5 is the total cost to the government. The employee contribution is considered a part of the entire budget. That is, the employee contribution is not considered in the FICA and Medicare columns because their contribution is ul- timately deducted from their salary. With that said, it is not necessary to show the contributions of both the employee and employer on a line item personnel If there are a number of employees who have the same salary, the budget officer may simply want to list the position by title and put the number of em budget ployees who correspond to that position/grade. This format saves time and space. However, this format only works when there are a nu who have the exact same salary. A request for a new now format. Howow