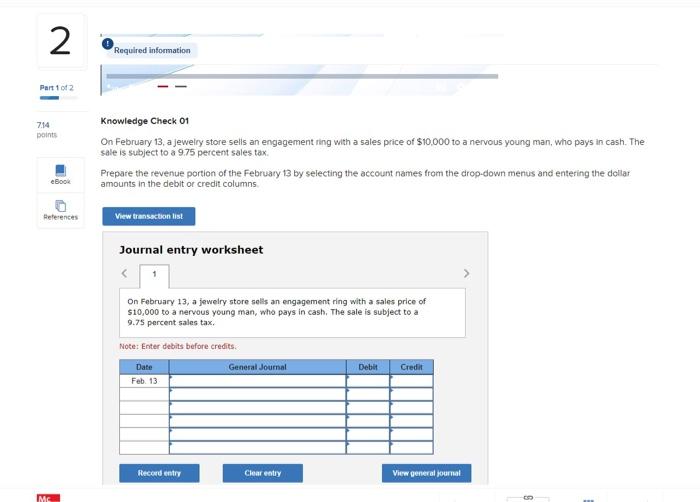

Question: 2 Required information Part 1 of 2 714 points Knowledge Check 01 On February 13, a jewelry store sells an engagement ring with a sales

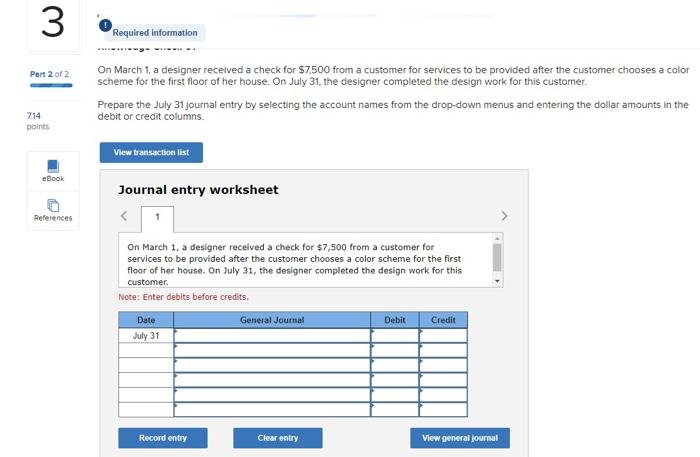

2 Required information Part 1 of 2 714 points Knowledge Check 01 On February 13, a jewelry store sells an engagement ring with a sales price of $10,000 to a nervous young man, who pays in cash. The sale is subject to a 975 percent sales tax. Prepare the revenue portion of the February 13 by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns eBook References View transaction is Journal entry worksheet On February 13, a jewelry store sells an engagement ring with a sales price of $10,000 to a nervous young man, who pays in cash. The sale is subject to a 9.75 percent sales tax. Note: Enter debits before credits Date General Journal Feb 13 Debut Credit Record entry Clear entry View general journal MC 2 ! Part 1 of 2 Required information Known (determinable) current liabilities are set by agreements or laws and are measurable with little uncertainty. They include accounts payable, sales taxes payable, unearned revenues, notes payable, payroll liabilities, and the current portion of long-term debt. 714 points 3 Required information Part 2 of 2 On March 1, a designer received a check for $7.500 from a customer for services to be provided after the customer chooses a color scheme for the first floor of her house. On July 31, the designer completed the design work for this customer. Prepare the July 31 journal entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns 214 points View transaction list eBook Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts