Question: 2 ! Required information Problem 11-8A Partner withdrawal and admission LO P3, P4 [The following information applies to the questions displayed below.] Meir, Benson, and

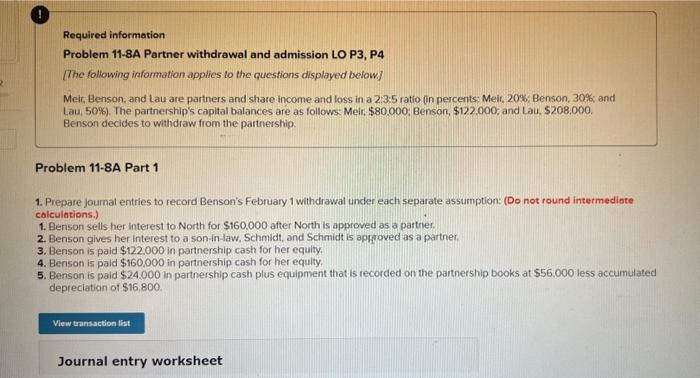

2 ! Required information Problem 11-8A Partner withdrawal and admission LO P3, P4 [The following information applies to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 2:3:5 ratio (in percents: Meir, 20%; Benson, 30%; and Lau, 50%). The partnership's capital balances are as follows: Meir, $80,000; Benson, $122,000; and Lau, $208,000. Benson decides to withdraw from the partnership. Problem 11-8A Part 1 1. Prepare journal entries to record Benson's February 1 withdrawal under each separate assumption: (Do not round intermediate calculations.) 1. Benson sells her interest to North for $160,000 after North is approved as a partner. 2. Benson gives her interest to a son-in-law, Schmidt, and Schmidt is approved as a partner. 3. Benson is paid $122,000 in partnership cash for her equity. 4. Benson is paid $160,000 in partnership cash for her equity. 5. Benson is paid $24,000 in partnership cash plus equipment that is recorded on the partnership books at $56,000 less accumulated depreciation of $16,800. View transaction list Journal entry worksheet A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock