Question: #2- Requires Respondus LockDown Browser st Information scription tructions ned Test This test has a time limit of 1 hour.This test will save and be

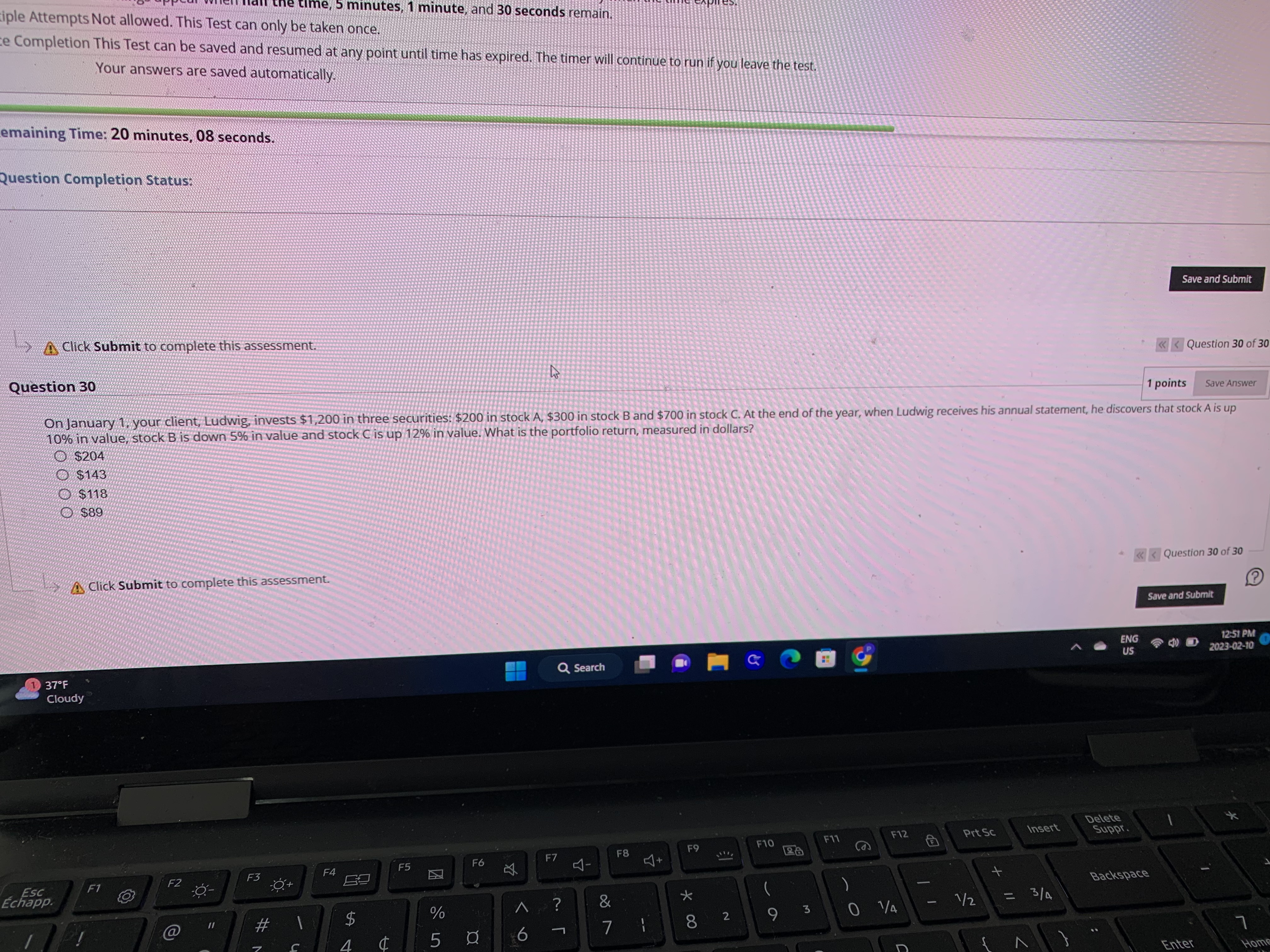

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock