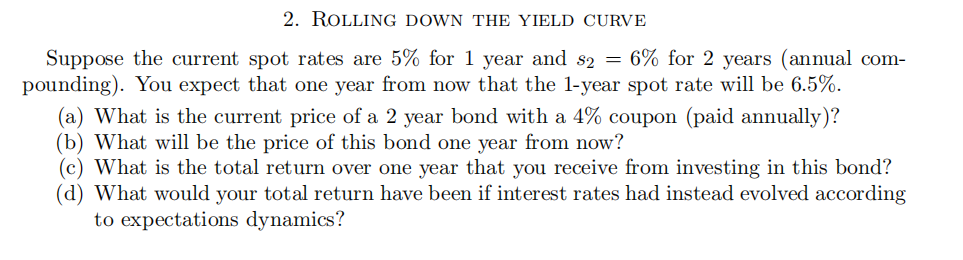

Question: 2. Rolling Down the YIELD CURVE Suppose the current spot rates are 5% for 1 year and s2=6% for 2 years (annual compounding). You expect

2. Rolling Down the YIELD CURVE Suppose the current spot rates are 5% for 1 year and s2=6% for 2 years (annual compounding). You expect that one year from now that the 1-year spot rate will be 6.5%. (a) What is the current price of a 2 year bond with a 4% coupon (paid annually)? (b) What will be the price of this bond one year from now? (c) What is the total return over one year that you receive from investing in this bond? (d) What would your total return have been if interest rates had instead evolved according to expectations dynamics? 2. Rolling Down the YIELD CURVE Suppose the current spot rates are 5% for 1 year and s2=6% for 2 years (annual compounding). You expect that one year from now that the 1-year spot rate will be 6.5%. (a) What is the current price of a 2 year bond with a 4% coupon (paid annually)? (b) What will be the price of this bond one year from now? (c) What is the total return over one year that you receive from investing in this bond? (d) What would your total return have been if interest rates had instead evolved according to expectations dynamics

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts