Question: 2. Second, consider the capital stack you will need to finance this property. Assume that you pay the sale price for which the property is

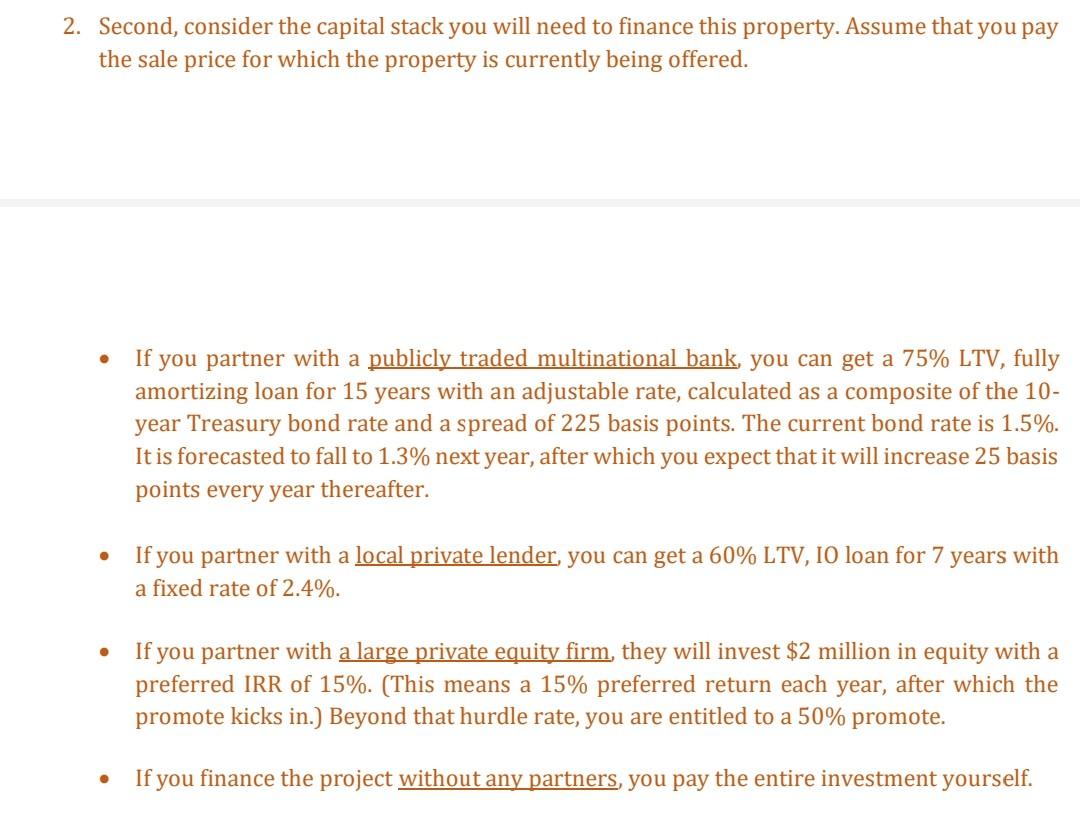

2. Second, consider the capital stack you will need to finance this property. Assume that you pay the sale price for which the property is currently being offered. If you partner with a publicly traded multinational bank, you can get a 75% LTV, fully amortizing loan for 15 years with an adjustable rate, calculated as a composite of the 10- year Treasury bond rate and a spread of 225 basis points. The current bond rate is 1.5%. It is forecasted to fall to 1.3% next year, after which you expect that it will increase 25 basis points every year thereafter. If you partner with a local private lender, you can get a 60% LTV, 10 loan for 7 years with a fixed rate of 2.4%. If you partner with a large private equity firm, they will invest $2 million in equity with a preferred IRR of 15%. (This means a 15% preferred return each year, after which the promote kicks in.) Beyond that hurdle rate, you are entitled to a 50% promote. If you finance the project without any partners, you pay the entire investment yourself. 2. Second, consider the capital stack you will need to finance this property. Assume that you pay the sale price for which the property is currently being offered. If you partner with a publicly traded multinational bank, you can get a 75% LTV, fully amortizing loan for 15 years with an adjustable rate, calculated as a composite of the 10- year Treasury bond rate and a spread of 225 basis points. The current bond rate is 1.5%. It is forecasted to fall to 1.3% next year, after which you expect that it will increase 25 basis points every year thereafter. If you partner with a local private lender, you can get a 60% LTV, 10 loan for 7 years with a fixed rate of 2.4%. If you partner with a large private equity firm, they will invest $2 million in equity with a preferred IRR of 15%. (This means a 15% preferred return each year, after which the promote kicks in.) Beyond that hurdle rate, you are entitled to a 50% promote. If you finance the project without any partners, you pay the entire investment yourself

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts