Question: 2. SECURITY VALUATION PROCESS AND MODELS Each security valuation represents a process that consists of few steps. First step assumes understanding and evaluation of an

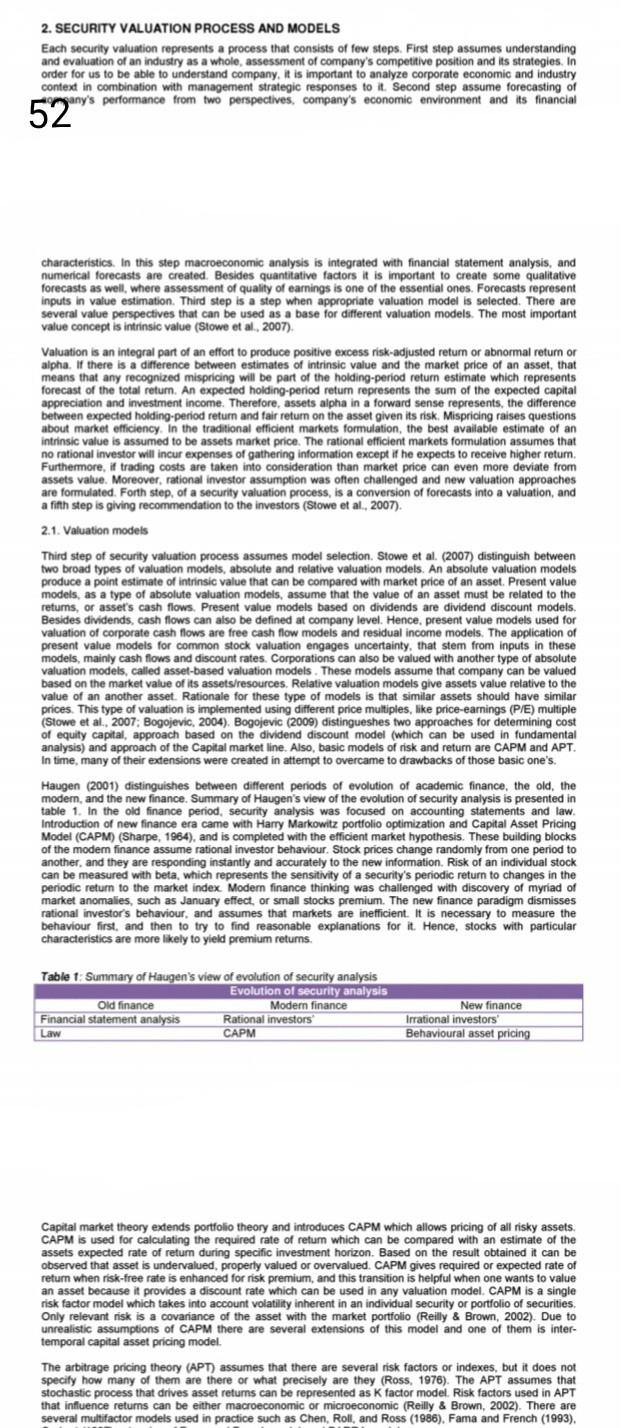

2. SECURITY VALUATION PROCESS AND MODELS Each security valuation represents a process that consists of few steps. First step assumes understanding and evaluation of an industry as a whole, assessment of company's competitive position and its strategies. In order for us to be able to understand company, it is important to analyze corporate economic and industry context in combination with management strategic responses to it Second step assume forecasting of any's performance from two perspectives, company's economic environment and its financial 52 characteristics. In this step macroeconomic analysis is integrated with financial statement analysis, and numerical forecasts are created. Besides quantitative factors it is important to create some qualitative forecasts as well, where assessment of quality of earnings is one of the essential ones. Forecasts represent inputs in value estimation. Third step is a step when appropriate valuation model is selected. There are several value perspectives that can be used as a base for different valuation models. The most important value concept is intrinsic value (Slowe et al., 2007) Valuation is an integral part of an effort to produce positive excess risk-adjusted return or abnormal return or alpha. If there is a difference between estimates of intrinsic value and the market price of an asset, that means that any recognized mispricing will be part of the holding-period return estimate which represents forecast of the total return. An expected holding period return represents the sum of the expected capital appreciation and investment income. Therefore, assets alpha in a forward sense represents, the difference between expected holding period return and fair return on the asset given its risk. Mispricing raises questions about market efficiency. In the traditional efficient markets formulation, the best available estimate of an intrinsic value is assumed to be assets market price. The rational efficient markets formulation assumes that no rational investor will incur expenses of gathering information except if he expects to receive higher retum. Furthermore, if trading costs are taken into consideration than market price can even more deviate from assets value. Moreover, rational investor assumption was often challenged and new valuation approaches are formulated. Forth step. of a security valuation process, is a conversion of forecasts into a valuation, and a fifth step is giving recommendation to the investors (Stowe et al., 2007) 2.1. Valuation models Third step of security valuation process assumes model selection. Stowe et al. (2007) distinguish between two broad types of valuation models, absolute and relative valuation models. An absolute valuation models produce a point estimate of intrinsic value that can be compared with market price of an asset. Present value models, as a type of absolute valuation models, assume that the value of an asset must be related to the returns, or asset's cash flows. Present value models based on dividends are dividend discount models Besides dividends, cash flows can also be defined at company level. Hence, present value models used for valuation of corporate cash flows are free cash flow models and residual income models. The application of present value models for common stock valuation engages uncertainty, that stem from inputs in these models, mainly cash flows and discount rates. Corporations can also be valued with another type of absolute valuation models, called asset-based valuation models. These models assume that company can be valued based on the market value of its assets/resources. Relative valuation models give assets value relative to the value of an another asset. Rationale for these type of models is that similar assets should have similar prices. This type of valuation is implemented using different price multiples, like price-earnings (P/E) multiple (Stowe et al., 2007: Bogojevic, 2004). Bogojevic (2009) distingueshes two approaches for determining cost of equity capital, approach based on the dividend discount model (which can be used in fundamental analysis) and approach of the Capital market line. Also, basic models of risk and return are CAPM and APT. In time, many of their extensions were created in attempt to overcame to drawbacks of those basic one's Haugen (2001) distinguishes between different periods of evolution of academic finance, the old, the modem, and the new finance. Summary of Haugen's view of the evolution of security analysis is presented in table 1. In the old finance period, security analysis was focused on accounting statements and law. Introduction of new finance era came with Harry Markowitz portfolio optimization and Capital Asset Pricing Model (CAPM) (Sharpe, 1964), and is completed with the efficient market hypothesis. These building blocks of the modern finance assume rational investor behaviour. Stock prices change randomly from one period to another, and they are responding instantly and accurately to the new information. Risk of an individual stock can be measured with beta represents the sensit of ecurity's periodic return to changes in the periodic return to the market index Modern finance thinking was challenged with discovery of myriad of market anomalies, such as January effect or small stocks premium. The new finance paradigm dismisses rational investor's behaviour, and assumes that markets are inefficient. It is necessary to measure the behaviour first and then to try to find reasonable explanations for it. Hence, stocks with particular characteristics are more likely to yield premium returns Table 1 Summary of Haugen's view of evolution of security analysis Evolution of security analysis Old finance Modern finance Financial statement analysis Rational investors Law New finance Irrational investors Behavioural asset pricing CAPM Capital market theory extends portfolio theory and introduces CAPM which allows pricing of all risky assets CAPM is used for calculating the required rate of return which can be compared with an estimate of the assets expected rate of return during specific investment horizon. Based on the result obtained it can be observed that asset is undervalued properly valued or overvalued. CAPM gives required or expected rate of return when risk-free rate is enhanced for risk premium, and this transition is helpful when one wants to value an asset because it provides a discount rate which can be used in any valuation model. CAPM is a single risk factor model which takes into account volatility inherent in an individual security or portfolio of securities Only relevant risk is a covariance of the asset with the market portfolio (Reilly & Brown, 2002). Due unrealistic assumptions of CAPM there are several extensions of this model and one of them is inter- temporal capital asset pricing model. The arbitrage pricing theory (APT) assumes that there are several risk factors or indexes, but it does not specify how many of them are there or what precisely are they (Ross, 1976). The APT assumes that stochastic process that drives asset retums can be represented as K factor model. Risk factors used in APT that influence returns can be either macroeconomic or microeconomic (Reilly & Brown, 2002). There are several multifactor models used in practice such as Chen, Roll, and Ross (1986). Fama and French (1993)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock