Question: 2 . Simple CAPM Estimation and Application ( 3 0 points ) In Canvas you'll find the TR _ CAPM. xlsx file. It has 4

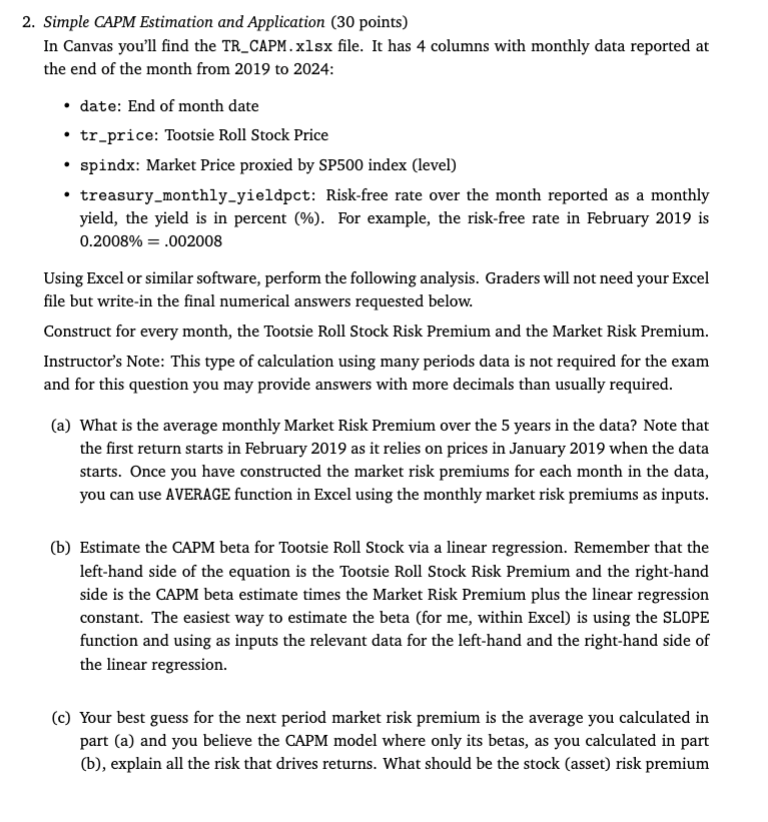

Simple CAPM Estimation and Application points In Canvas you'll find the TRCAPM. xlsx file. It has columns with monthly data reported at the end of the month from to : date: End of month date trprice: Tootsie Roll Stock Price spindx: Market Price proxied by SP index level treasurymonthlyyieldpct: Riskfree rate over the month reported as a monthly yield, the yield is in percent For example, the riskfree rate in February is Using Excel or similar software, perform the following analysis. Graders will not need your Excel file but writein the final numerical answers requested below. Construct for every month, the Tootsie Roll Stock Risk Premium and the Market Risk Premium. Instructor's Note: This type of calculation using many periods data is not required for the exam and for this question you may provide answers with more decimals than usually required. a What is the average monthly Market Risk Premium over the years in the data? Note that the first return starts in February as it relies on prices in January when the data starts. Once you have constructed the market risk premiums for each month in the data, you can use AVERAGE function in Excel using the monthly market risk premiums as inputs. b Estimate the CAPM beta for Tootsie Roll Stock via a linear regression. Remember that the lefthand side of the equation is the Tootsie Roll Stock Risk Premium and the righthand side is the CAPM beta estimate times the Market Risk Premium plus the linear regression constant. The easiest way to estimate the beta for me within Excel is using the SLOPE function and using as inputs the relevant data for the lefthand and the righthand side of the linear regression. c Your best guess for the next period market risk premium is the average you calculated in part a and you believe the CAPM model where only its betas, as you calculated in part b explain all the risk that drives returns. What should be the stock asset risk premium of Tootsie Roll according to CAPM for the next period?

For your own edification. Ask an AI platform of your choice or use a financial information platform such as Yahoo! Finance to find Tootsie Roll's beta. The number should be similar to what you calculated in part b with minor differences explained by what exact raw data is used to estimate CAPM beta.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock