Question: 2. Skyport Systems provides cloud-managed, hyper-converged systems that run and protect business-critical applications. On January 1, 2015, Skyport issued $1,500,000 of 9% bonds, due in

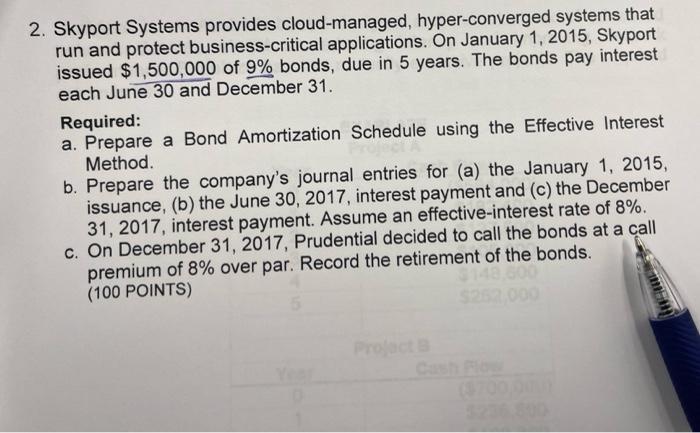

2. Skyport Systems provides cloud-managed, hyper-converged systems that run and protect business-critical applications. On January 1, 2015, Skyport issued $1,500,000 of 9% bonds, due in 5 years. The bonds pay interest each June 30 and December 31. Required: a. Prepare a Bond Amortization Schedule using the Effective Interest Method. b. Prepare the company's journal entries for (a) the January 1, 2015, issuance, (b) the June 30, 2017, interest payment and (c) the December 31, 2017, interest payment. Assume an effective-interest rate of 8%. c. On December 31, 2017, Prudential decided to call the bonds at a call premium of 8% over par. Record the retirement of the bonds. (100 POINTS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts