Question: 2. Spatial and Triangular Arbitrage a. Suppose that the dollar-euro exchange rate is E 1.10 in New York and E 1.05 in Tokyo. Describe how

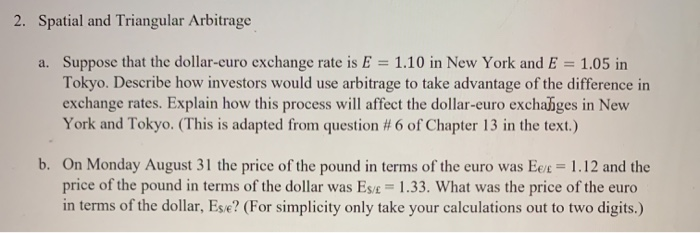

2. Spatial and Triangular Arbitrage a. Suppose that the dollar-euro exchange rate is E 1.10 in New York and E 1.05 in Tokyo. Describe how investors would use arbitrage to take advantage of the difference in exchange rates. Explain how this process will affect the dollar-euro exchanges in New York and Tokyo. (This is adapted from question #6 of Chapter 13 in the text.) b. On Monday August 31 the price of the pound in terms of the euro was Eee = 1.12 and the price of the pound in terms of the dollar was Es/ = 1.33. What was the price of the euro in terms of the dollar, Ese? (For simplicity only take your calculations out to two digits.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts