Question: 2 Stochastic Processes and LogNormal Distribution Problem 2.1. A stock is trading at $100. Assume that the stock price follows lognormal distribution. The expected return

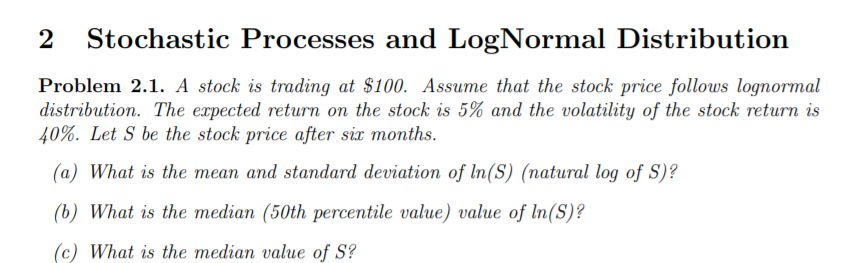

2 Stochastic Processes and LogNormal Distribution Problem 2.1. A stock is trading at $100. Assume that the stock price follows lognormal distribution. The expected return on the stock is 5% and the volatility of the stock return is 40%. Let S be the stock price after six months. (a) What is the mean and standard deviation of In(S) (natural log of S)? (6) What is the median (50th percentile value) value of ln(S)? (c) What is the median value of S? 2 Stochastic Processes and LogNormal Distribution Problem 2.1. A stock is trading at $100. Assume that the stock price follows lognormal distribution. The expected return on the stock is 5% and the volatility of the stock return is 40%. Let S be the stock price after six months. (a) What is the mean and standard deviation of In(S) (natural log of S)? (6) What is the median (50th percentile value) value of ln(S)? (c) What is the median value of S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts