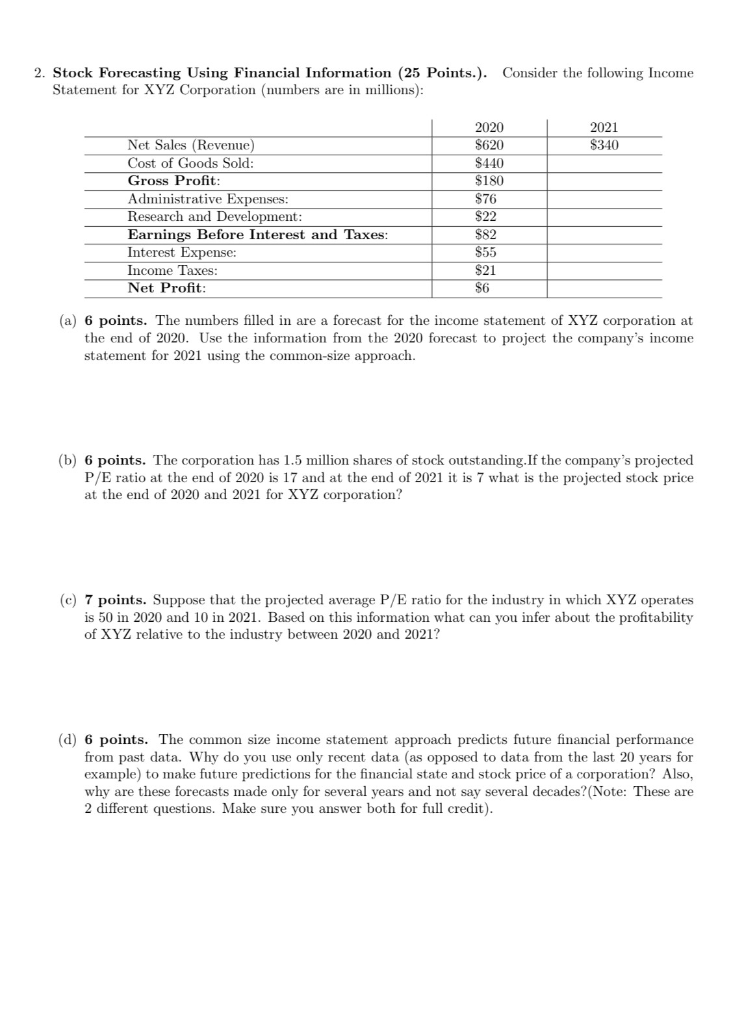

Question: 2. Stock Forecasting Using Financial Information (25 Points.). Consider the following Income Statement for XYZ Corporation numbers are in millions): 2021 $340 Net Sales (Revenue)

2. Stock Forecasting Using Financial Information (25 Points.). Consider the following Income Statement for XYZ Corporation numbers are in millions): 2021 $340 Net Sales (Revenue) Cost of Goods Sold: Gross Profit: Administrative Expenses: Research and Development: Earnings Before Interest and Taxes: Interest Expense: Income Taxes: Net Profit: 2020 $620 $440 $180 $76 $22 $82 $55 $21 $6 (a) 6 points. The numbers filled in are a forecast for the income statement of XYZ corporation at the end of 2020. Use the information from the 2020 forecast to project the company's income statement for 2021 using the common-size approach. (b) 6 points. The corporation has 1.5 million shares of stock outstanding. If the company's projected P/E ratio at the end of 2020 is 17 and at the end of 2021 it is 7 what is the projected stock price at the end of 2020 and 2021 for XYZ corporation? (c) 7 points. Suppose that the projected average P/E ratio for the industry in which XYZ operates is 50 in 2020 and 10 in 2021. Based on this information what can you infer about the profitability of XYZ relative to the industry between 2020 and 2021? (d) 6 points. The common size income statement approach predicts future financial performance from past data. Why do you use only recent data (as opposed to data from the last 20 years for example) to make future predictions for the financial state and stock price of a corporation? Also, why are these forecasts made only for several years and not say several decades? (Note: These are 2 different questions. Make sure you answer both for full credit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts