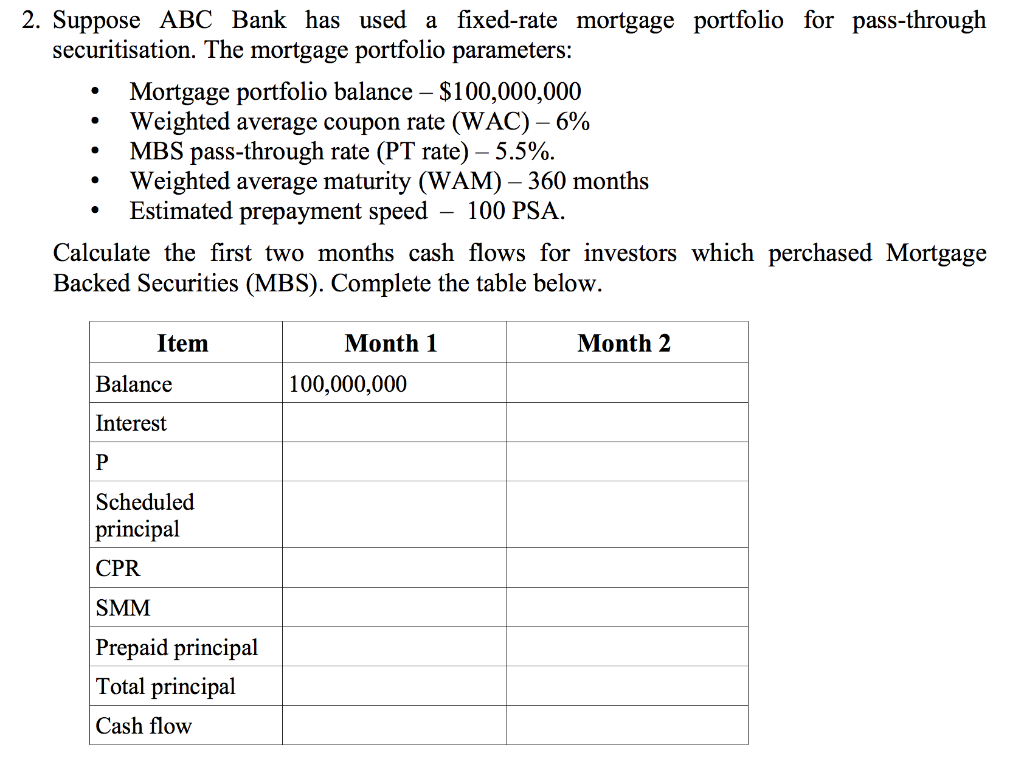

Question: . . . 2. Suppose ABC Bank has used a fixed-rate mortgage portfolio for pass-through securitisation. The mortgage portfolio parameters: Mortgage portfolio balance - $100,000,000

. . . 2. Suppose ABC Bank has used a fixed-rate mortgage portfolio for pass-through securitisation. The mortgage portfolio parameters: Mortgage portfolio balance - $100,000,000 Weighted average coupon rate (WAC) 6% MBS pass-through rate (PT rate) 5.5%. Weighted average maturity (WAM) 360 months Estimated prepayment speed 100 PSA. Calculate the first two months cash flows for investors which perchased Mortgage Backed Securities (MBS). Complete the table below. . . Item Month 1 Month 2 Balance 100,000,000 Interest P Scheduled principal CPR SMM Prepaid principal Total principal Cash flow . . . 2. Suppose ABC Bank has used a fixed-rate mortgage portfolio for pass-through securitisation. The mortgage portfolio parameters: Mortgage portfolio balance - $100,000,000 Weighted average coupon rate (WAC) 6% MBS pass-through rate (PT rate) 5.5%. Weighted average maturity (WAM) 360 months Estimated prepayment speed 100 PSA. Calculate the first two months cash flows for investors which perchased Mortgage Backed Securities (MBS). Complete the table below. . . Item Month 1 Month 2 Balance 100,000,000 Interest P Scheduled principal CPR SMM Prepaid principal Total principal Cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts