Question: 2. Suppose that Green had used the direct write-off method to account for bad debts, Compute the following ($ in millions) a. The accounts receivable

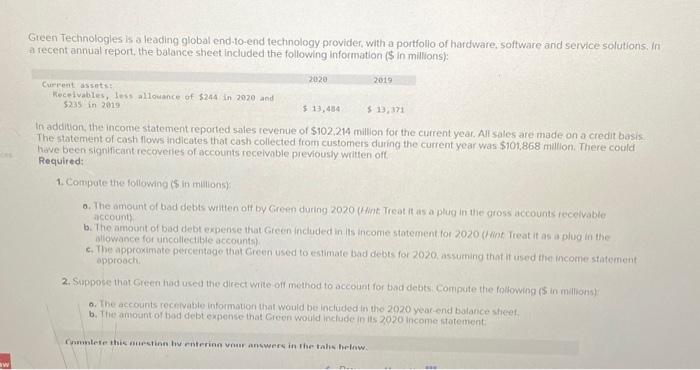

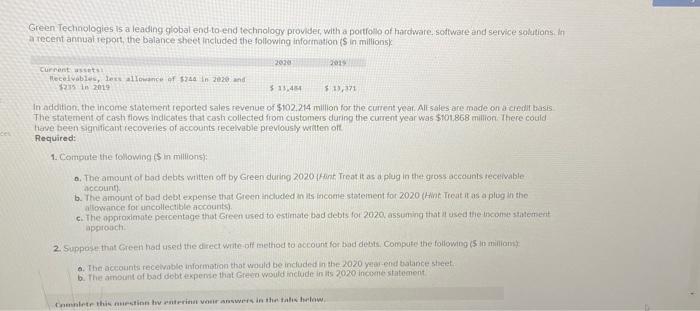

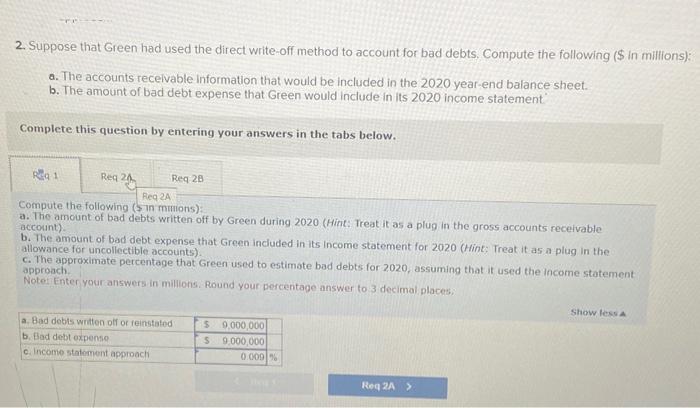

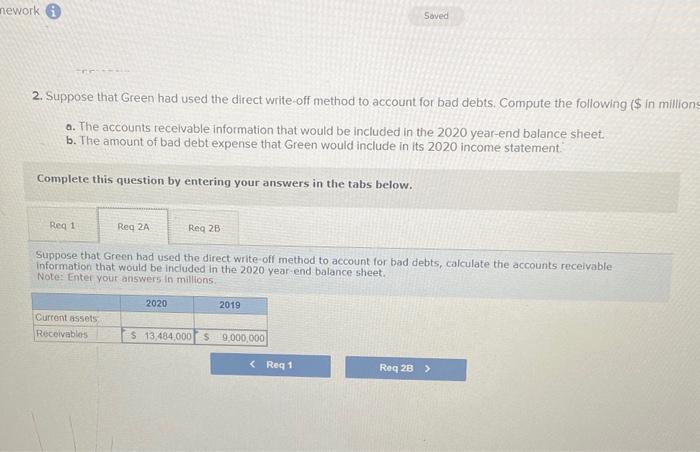

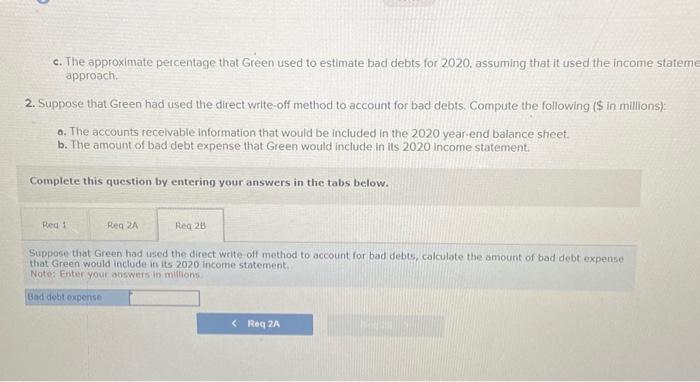

2. Suppose that Green had used the direct write-off method to account for bad debts, Compute the following (\$ in millions) a. The accounts receivable information that would be included in the 2020 year-end balance sheet. b. The amount of bad debt expense that Green would include in its 2020 income statement. Complete this question by entering your answers in the tabs below. Compute the following ( $ in mmions): a. The amount of bad debts written off by Green during 2020 (Hint: Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green induded in its income statement for 2020 (Hint: Treat it as a plug in the allowance for uncollectible accounts). C. The approximate percentage that Green used to estimate bad debts for 2020 , assuming that it used the income statement approach. Notes Enter your answers in millions. Round your percentage answer to 3 decimal places. Gieen Technologles is a leading global end-to-end technology provider, with a portfollo of hardware, software and service solutions, in a recent annual report, the balance sheet included the following information (\$ in millions): In addition, the income statement reported sales revenue of $102,214 million for the current year. All sales are made on a credit basis The statement of costh flows indicates that cash collected from customers during the current year was $101,868 million. There could have been significant recoveries of accounts recelvable previously written off Requited: 1. Compute the followng is in milions) 0. The amount of bad debts whitten off by Green during 2020 (Hint Treat it as a plug in the gross accounts recelvable account b. The amount of bad debt expense that Green included in its income statement for 2020 (hant Freat it as a olua in the c. The approximate percentage that Creen used to estimate tad debs for 2020 , ssuming that if used the income statement approach. 2. Suppose that Green had used the direct write off method to account for bad debts. Comipute the following (\$ in millions): 0. The accounts recefvable intormation that would be included in tho 2020 yeat-end bolance sheet. c. The approximate percentage that Green used to estimate bad debts for 2020 . assuming that it used the income stater approach. 2. Suppose that Green had used the direct write-off method to account for bad debts. Compute the following (\$ in millions): Q. The accounts recelvable information that woutd be included in the 2020 year-end batance sheet. b. The amount of bad debt expense that Green would include in its 2020 income statement. Complete this question by entering your answers in the tabs below. Suppose that Green had used the direct write off method to account for bad debts, calculate the amount of bad debt expense that Green would include in its 2020 income statement. Note: Enter your ooswers in miltions 2. Suppose that Green had used the direct write-off method to account for bad debts. Compute the following (\$ in millior a. The accounts recelvable information that would be included in the 2020 year-end balance sheet. b. The amount of bad debt expense that Green would include in its 2020 income statement. Complete this question by entering your answers in the tabs below. Suppose that Green had used the direct write-off method to account for bad debts, calculate the accounts receivable information that would be included in the 2020 year-end balance sheet. Note: Enter your answers in millions. Green Technologies is a leading global end-to-end technology provider, with a portioto of harcware. softwate and service solutions if a recent annual report, the balance sheet included the following inforination is in millions: In addition, the incorre statenient reported sales revenue of $102.214 million for the current year Ali sales are made on a ciedir basis The statement of cash flows indicates that cash collected fiom customers during the current year was $101.868 million-There could tirve theen sanificaist recoveries of accounts recelvable previousiy written oft. Required: 1. Compute the following is in millions): 0. The amount of bad debts witten off by Green duinip 2020 fHant. Treat it as a plug in thet gross accounis rectivable account. b. The ampont of bat debl expense that Green included in is incoete statement for 2020 (Hint Treat it as a plog in the allowrince for uncollectible accounts). c. The oppraximate percentage that Geen used to estimate bad debis for 2020 assuming that if used the uxconse statement approuch. a. The acicounts recelvable information thot would be included in the 2020 year-end batance sheef

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts