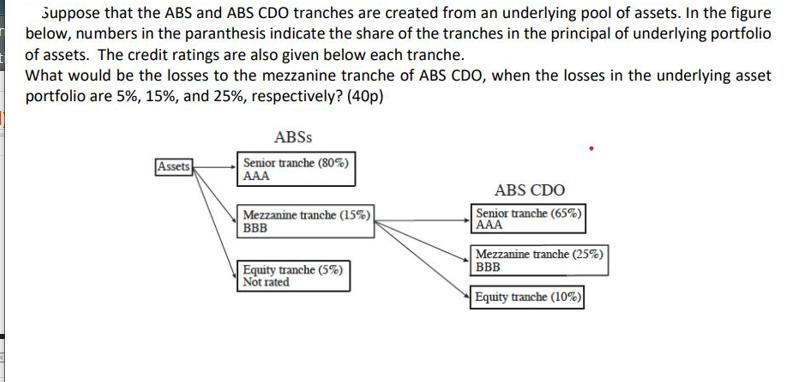

Question: Suppose that the ABS and ABS CDO tranches are created from an underlying pool of assets. In the figure below, numbers in the paranthesis

Suppose that the ABS and ABS CDO tranches are created from an underlying pool of assets. In the figure below, numbers in the paranthesis indicate the share of the tranches in the principal of underlying portfolio of assets. The credit ratings are also given below each tranche. What would be the losses to the mezzanine tranche of ABS CDO, when the losses in the underlying asset portfolio are 5%, 15%, and 25%, respectively? (40p) Assets ABSS Senior tranche (80%) AAA Mezzanine tranche (15%) BBB Equity tranche (5%) Not rated ABS CDO Senior tranche (65%) AAA Mezzanine tranche (25%) BBB Equity tranche (10%)

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

The image you provided shows a structure of AssetBacked Securities ABS and Collateralized Debt Obligations CDOs created from an underlying pool of assets The ABS has three tranches senior mezzanine an... View full answer

Get step-by-step solutions from verified subject matter experts