Question: 2. Suppose that the current yield on 10-year maturity Treasury note is 3% and the current yield on 10-year maturity TIPS is 0.5%. If the

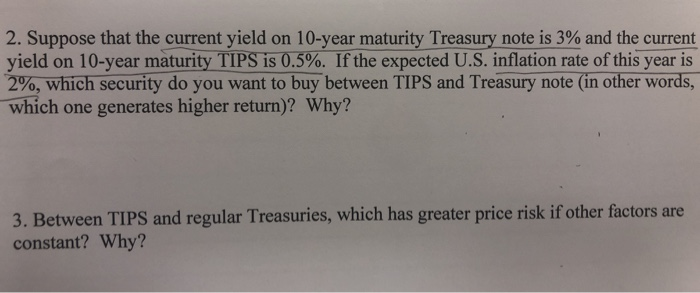

2. Suppose that the current yield on 10-year maturity Treasury note is 3% and the current yield on 10-year maturity TIPS is 0.5%. If the expected U.S. inflation rate of this year is 2%, which security do you want to buy between TIPS and Treasury note (in other words, which one generates higher return)? Why? 3. Between TIPS and regular Treasuries, which has greater price risk if other factors are constant? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts