Question: 2) Suppose you bought 20 put option contracts with a strike price of $49.9. The option premium is $3.1 per contract. Just before the option

2) Suppose you bought 20 put option contracts with a strike price of $49.9. The option premium is $3.1 per contract. Just before the option expires, the stock is selling for $46.51. What is your net profit (or loss)? Ignore commissions. (Assume each option contract is based on 100 shares of stock) (Note: Please retain at least 4 decimal places in your calculations and 2 decimal places in the final answer) the net profit (or loss) is $ _______

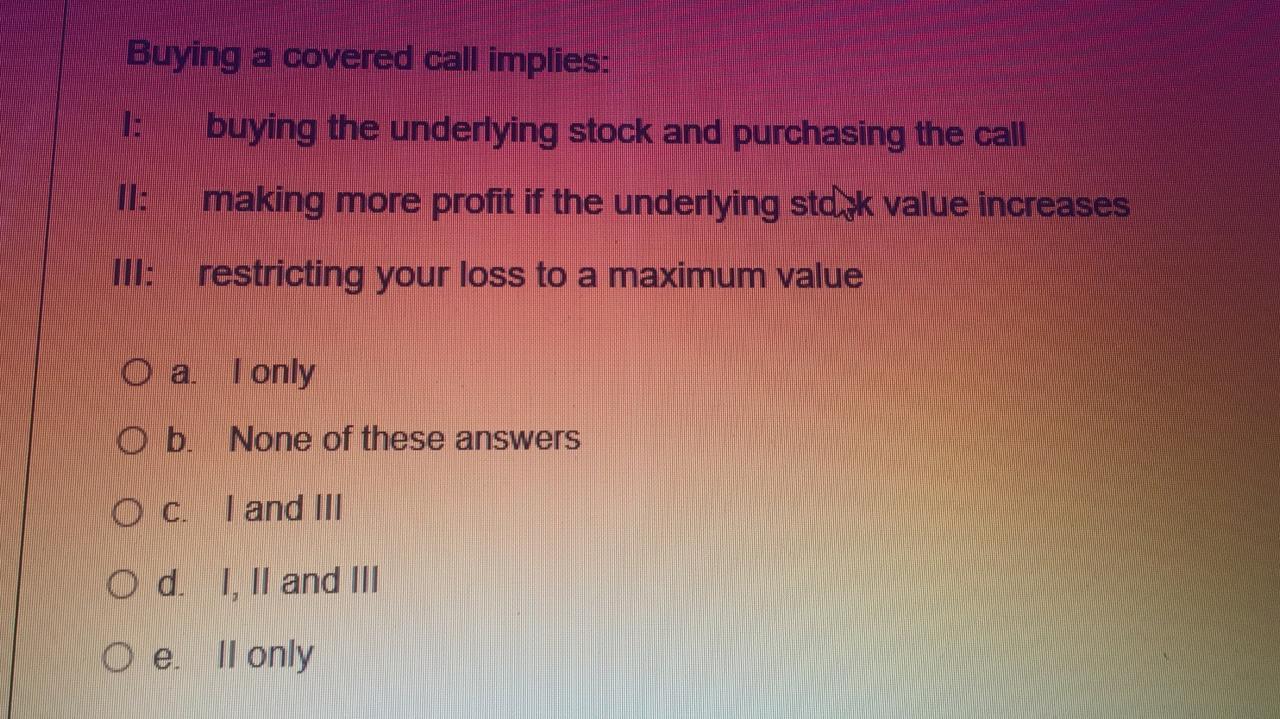

Buying a covered call implies: 1: buying the underlying stock and purchasing the call making more profit if the underlying stok value increases III: restricting your loss to a maximum value O a. I only O b None of these answers Oc. I and III O d. I, II and III o e. Il only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts