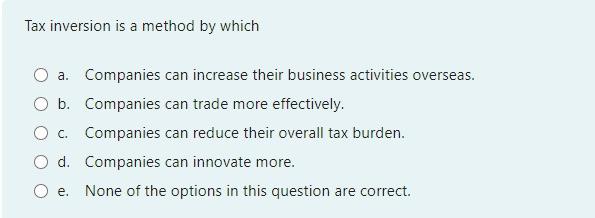

Question: 2 Tax inversion is a method by which O a. Companies can increase their business activities overseas. O b. Companies can trade more effectively. OC.

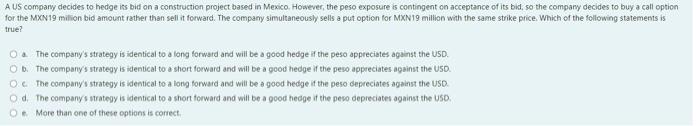

Tax inversion is a method by which O a. Companies can increase their business activities overseas. O b. Companies can trade more effectively. OC. Companies can reduce their overall tax burden. O d. Companies can innovate more. None of the options in this question are correct. e. A US company decides to hedge its bid on a construction project based in Mexico. However, the peso exposure is contingent on acceptance of its bid, so the company decides to buy a call option for the MXN 19 milion bid amount rather than sell it forward. The company simultaneously sells a put option for MXN19 million with the same strike price. Which of the following statements is true? O. The company's strategy is identical to a long forward and will be a good hedge if the peso appreciates against the USD. ObThe company's strategy is identical to a short forward and will be a good hedge if the peso appreciates against the USD. 0. The company's strategy is identical to a long forward and will be a good hedge if the peso depreciates against the USD. od The company's strategy is identical to a short forward and will be a good hedge if the pero depreciates against the US De More than one of these option is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts