Question: 2. The CMBS issue presented as an example in the slides is based on a pool consisting of 10 commercial loans, each with a balance

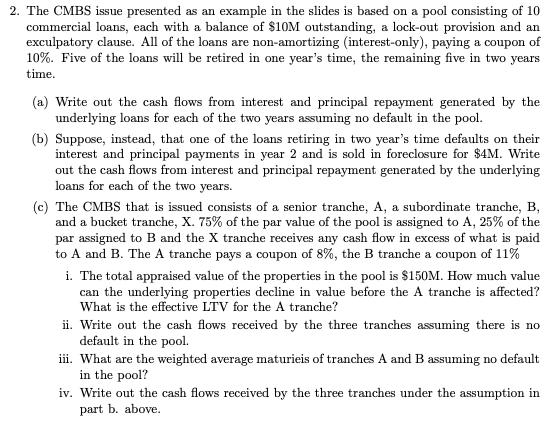

2. The CMBS issue presented as an example in the slides is based on a pool consisting of 10 commercial loans, each with a balance of $10M outstanding, a lock-out provision and an exculpatory clause. All of the loans are non-amortizing interest-only), paying a coupon of 10%. Five of the loans will be retired in one year's time, the remaining five in two years time. (a) Write out the cash flows from interest and principal repayment generated by the underlying loans for each of the two years assuming no default in the pool. (b) Suppose, instead, that one of the loans retiring in two year's time defaults on their interest and principal payments in year 2 and is sold in foreclosure for $4M. Write out the cash flows from interest and principal repayment generated by the underlying loans for each of the two years. (c) The CMBS that is issued consists of a senior tranche, A, a subordinate tranche, B, and a bucket tranche, X. 75% of the par value of the pool is assigned to A, 25% of the par assigned to B and the X tranche receives any cash flow in excess of what is paid to A and B. The A tranche pays a coupon of 8%, the B tranche a coupon of 11% i. The total appraised value of the properties in the pool is $150M. How much value can the underlying properties decline in value before the A tranche is affected? What is the effective LTV for the A tranche? ii. Write out the cash flows received by the three tranches assuming there is no default in the pool. iii. What are the weighted average maturieis of tranches A and B assuming no default in the pool? iv. Write out the cash flows received by the three tranches under the assumption in part b. above. 2. The CMBS issue presented as an example in the slides is based on a pool consisting of 10 commercial loans, each with a balance of $10M outstanding, a lock-out provision and an exculpatory clause. All of the loans are non-amortizing interest-only), paying a coupon of 10%. Five of the loans will be retired in one year's time, the remaining five in two years time. (a) Write out the cash flows from interest and principal repayment generated by the underlying loans for each of the two years assuming no default in the pool. (b) Suppose, instead, that one of the loans retiring in two year's time defaults on their interest and principal payments in year 2 and is sold in foreclosure for $4M. Write out the cash flows from interest and principal repayment generated by the underlying loans for each of the two years. (c) The CMBS that is issued consists of a senior tranche, A, a subordinate tranche, B, and a bucket tranche, X. 75% of the par value of the pool is assigned to A, 25% of the par assigned to B and the X tranche receives any cash flow in excess of what is paid to A and B. The A tranche pays a coupon of 8%, the B tranche a coupon of 11% i. The total appraised value of the properties in the pool is $150M. How much value can the underlying properties decline in value before the A tranche is affected? What is the effective LTV for the A tranche? ii. Write out the cash flows received by the three tranches assuming there is no default in the pool. iii. What are the weighted average maturieis of tranches A and B assuming no default in the pool? iv. Write out the cash flows received by the three tranches under the assumption in part b. above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts