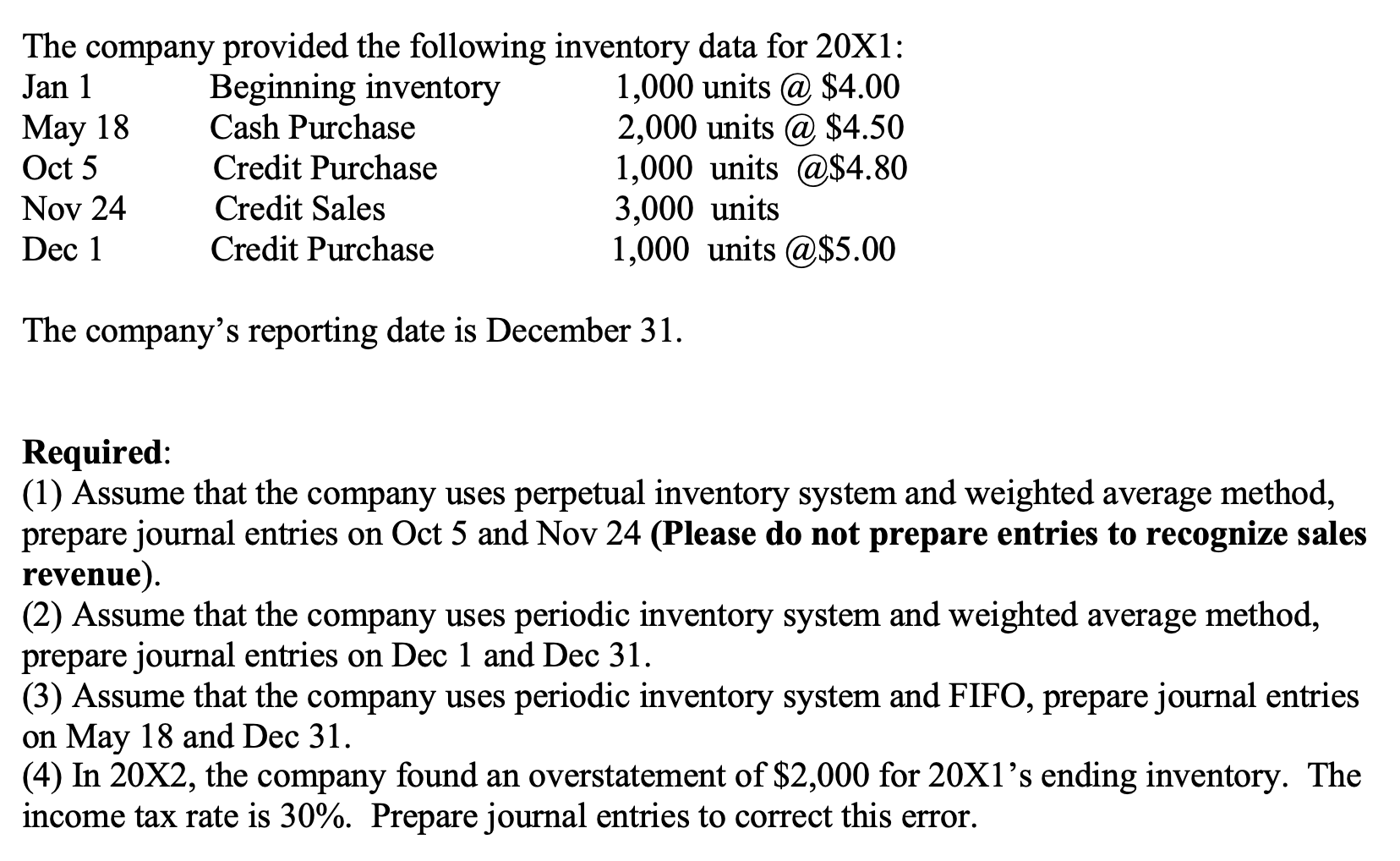

Question: 2 . The company provided the following inventory data for 2 0 X 1 : Jan 1 Beginning inventory 1 , 0 0 0 units

The company provided the following inventory data for X:

Jan Beginning inventory units @ $

May Cash Purchase units @ $

Oct Credit Purchase units @$

Nov Credit Sales units@

Dec Credit Purchase units @$

The companys reporting date is December

Required marks:

Assume that the company uses perpetual inventory system and weighted average method, prepare journal entries on Oct and Nov

Assume that the company uses periodic inventory system and weighted average method, prepare journal entries on Dec and Dec

Assume that the company uses periodic inventory system and FIFO, prepare journal entries on May and Dec

In X the company found an understatement of $ for Xs ending inventory. The income tax rate is Prepare journal entries to correct this error.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock