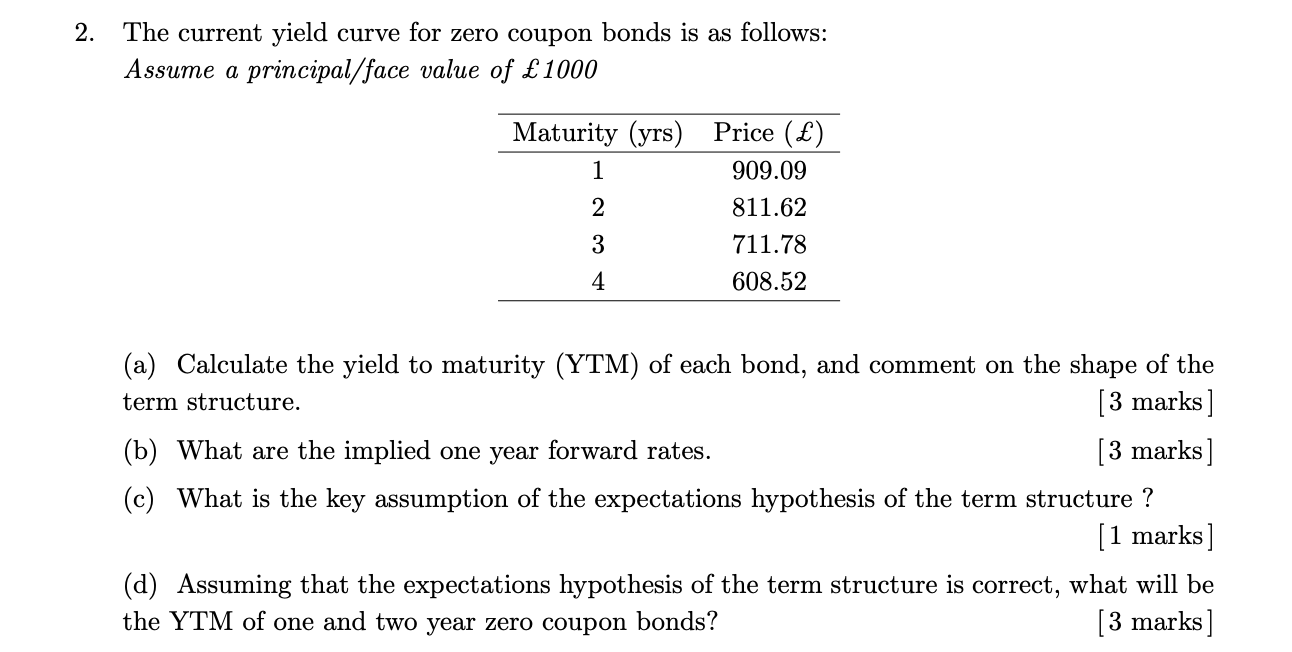

Question: 2. The current yield curve for zero coupon bonds is as follows: Assume a principal/face value of 1000 Maturity (yrs) Price () 909.09 811.62 711.78

2. The current yield curve for zero coupon bonds is as follows: Assume a principal/face value of 1000 Maturity (yrs) Price () 909.09 811.62 711.78 608.52 (a) Calculate the yield to maturity (YTM) of each bond, and comment on the shape of the term structure. [3 marks] (b) What are the implied one year forward rates. [3 marks] (c) What is the key assumption of the expectations hypothesis of the term structure ? [1 marks] (d) Assuming that the expectations hypothesis of the term structure is correct, what will be the YTM of one and two year zero coupon bonds? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts