Question: 2) The duration gap between assets and liabilities is a measure of interest rate risk for Fls. If the durations between liabilities and assets are

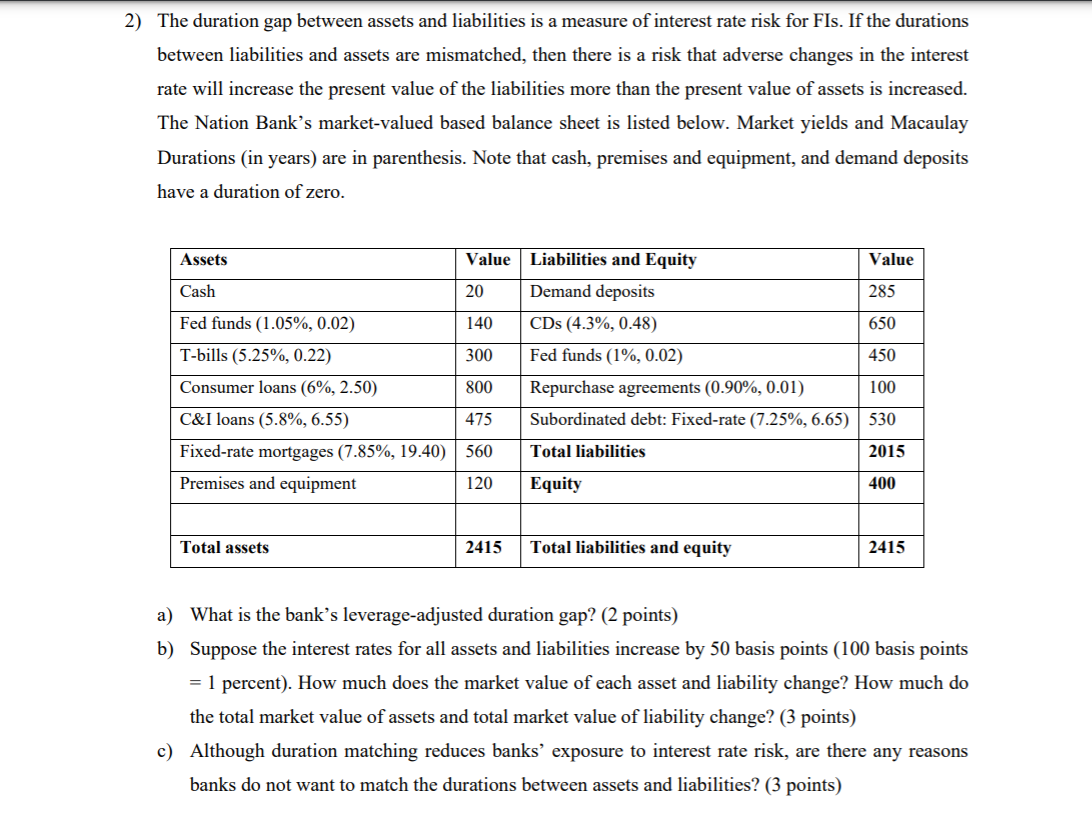

2) The duration gap between assets and liabilities is a measure of interest rate risk for Fls. If the durations between liabilities and assets are mismatched, then there is a risk that adverse changes in the interest rate will increase the present value of the liabilities more than the present value of assets is increased. The Nation Bank's market-valued based balance sheet is listed below. Market yields and Macaulay Durations (in years) are in parenthesis. Note that cash, premises and equipment, and demand deposits have a duration of zero. Assets Value Value Liabilities and Equity Demand deposits Cash 20 285 Fed funds (1.05%, 0.02) 140 650 CDs (4.3%, 0.48) Fed funds (1%, 0.02) T-bills (5.25%, 0.22) 300 450 800 Repurchase agreements (0.90%, 0.01) 100 Subordinated debt: Fixed-rate (7.25%, 6.65) 530 475 Consumer loans (6%, 2.50) C&I loans (5.8%, 6.55) Fixed-rate mortgages (7.85%, 19.40) Premises and equipment 560 Total liabilities 2015 120 Equity 400 Total assets 2415 Total liabilities and equity 2415 a) What is the bank's leverage-adjusted duration gap? (2 points) b) Suppose the interest rates for all assets and liabilities increase by 50 basis points (100 basis points = 1 percent). How much does the market value of each asset and liability change? How much do the total market value of assets and total market value of liability change? (3 points) c) Although duration matching reduces banks' exposure to interest rate risk, are there any reasons banks do not want to match the durations between assets and liabilities? (3 points) 2) The duration gap between assets and liabilities is a measure of interest rate risk for Fls. If the durations between liabilities and assets are mismatched, then there is a risk that adverse changes in the interest rate will increase the present value of the liabilities more than the present value of assets is increased. The Nation Bank's market-valued based balance sheet is listed below. Market yields and Macaulay Durations (in years) are in parenthesis. Note that cash, premises and equipment, and demand deposits have a duration of zero. Assets Value Value Liabilities and Equity Demand deposits Cash 20 285 Fed funds (1.05%, 0.02) 140 650 CDs (4.3%, 0.48) Fed funds (1%, 0.02) T-bills (5.25%, 0.22) 300 450 800 Repurchase agreements (0.90%, 0.01) 100 Subordinated debt: Fixed-rate (7.25%, 6.65) 530 475 Consumer loans (6%, 2.50) C&I loans (5.8%, 6.55) Fixed-rate mortgages (7.85%, 19.40) Premises and equipment 560 Total liabilities 2015 120 Equity 400 Total assets 2415 Total liabilities and equity 2415 a) What is the bank's leverage-adjusted duration gap? (2 points) b) Suppose the interest rates for all assets and liabilities increase by 50 basis points (100 basis points = 1 percent). How much does the market value of each asset and liability change? How much do the total market value of assets and total market value of liability change? (3 points) c) Although duration matching reduces banks' exposure to interest rate risk, are there any reasons banks do not want to match the durations between assets and liabilities? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts