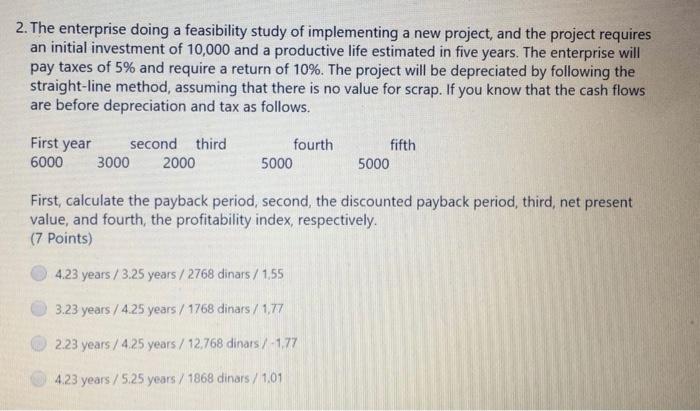

Question: 2. The enterprise doing a feasibility study of implementing a new project, and the project requires an initial investment of 10,000 and a productive life

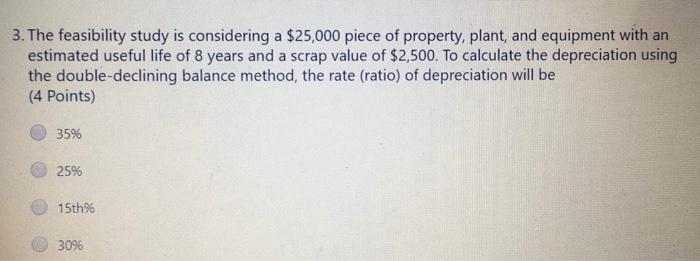

2. The enterprise doing a feasibility study of implementing a new project, and the project requires an initial investment of 10,000 and a productive life estimated in five years. The enterprise will pay taxes of 5% and require a return of 10%. The project will be depreciated by following the straight-line method, assuming that there is no value for scrap. If you know that the cash flows are before depreciation and tax as follows. fourth First year second third 6000 3000 2000 fifth 5000 5000 First, calculate the payback period, second, the discounted payback period, third, net present value, and fourth, the profitability index, respectively. (7 points) 4.23 years / 3.25 years / 2768 dinars/155 3.23 years / 4.25 years / 1768 dinars / 1,77 2.23 years / 4.25 years / 12,768 dinars/ -177 4.23 years/5.25 years / 1868 dinars / 1.01 3. The feasibility study is considering a $25,000 piece of property, plant, and equipment with an estimated useful life of 8 years and a scrap value of $2,500. To calculate the depreciation using the double-declining balance method, the rate (ratio) of depreciation will be (4 Points) 35% 25% 15th96 30% 2. The enterprise doing a feasibility study of implementing a new project, and the project requires an initial investment of 10,000 and a productive life estimated in five years. The enterprise will pay taxes of 5% and require a return of 10%. The project will be depreciated by following the straight-line method, assuming that there is no value for scrap. If you know that the cash flows are before depreciation and tax as follows. fourth First year second third 6000 3000 2000 fifth 5000 5000 First, calculate the payback period, second, the discounted payback period, third, net present value, and fourth, the profitability index, respectively. (7 points) 4.23 years / 3.25 years / 2768 dinars/155 3.23 years / 4.25 years / 1768 dinars / 1,77 2.23 years / 4.25 years / 12,768 dinars/ -177 4.23 years/5.25 years / 1868 dinars / 1.01 3. The feasibility study is considering a $25,000 piece of property, plant, and equipment with an estimated useful life of 8 years and a scrap value of $2,500. To calculate the depreciation using the double-declining balance method, the rate (ratio) of depreciation will be (4 Points) 35% 25% 15th96 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts